Crafting a compelling bookkeeper resume might seem daunting, especially if you're unsure about its core elements. This comprehensive guide aims to simplify the process for you.

Packed with relevant tips and concrete examples, you'll learn the essentials of resume writing that can help elevate your chances in the competitive job market.

Let's delve into:

- 3 specific bookkeeper resume samples

- Formatting your bookkeeper resume properly

- Creating a robust resume summary or objective

- Choosing the best skills for your bookkeeper resume

- Framing an appealing work experience and key projects section

- Listing your education appropriately

- Including extra sections that will make your bookkeeper resume stand out from the crowd

- When to include a bookkeeper cover letter

- Bookkeeping resources

- Average salary and outlook for bookkeepers

Oh, and if you want to turn your LinkedIn profile into a resume with just one click, we've got you covered.

Trust accountant resume example

Why does this resume example work?

- The certificates section is a real strength: The candidate includes a CPA credential, which is a big deal in this field. It shows that this person is committed and also has credibility. Recruiters look for signals that an applicant understands regulations and can handle sensitive financial work, and a certificate like this does exactly that.

- The candidate uses clear action verbs: Most of the bullet points start with active language like reviewed, processed, generated, collaborated, or assisted. This helps the reader picture what the applicant actually did instead of making the work sound passive or vague. It also makes the whole work experience section feel more energetic and easier to follow.

Is there a way to do it a little better?

- The resume could talk more about results, not just duties: Most of the bullets describe what the applicant did, but none of them say what happened because of that work. Even small metrics help, like speeding up payment processing, reducing errors, or improving reporting accuracy. These details make the applicant look more impactful and help a hiring manager see the value of bringing this person onto the team.

- The hobbies section doesn’t add much value: Hobbies can work on a resume, but only if they support the story of the applicant as a professional. Something like volunteering related to finance or community budgeting might help, but broad phrases like exploring distant lands or getting lost in a good book don’t tell a hiring manager anything relevant. They take up space that could be used for extra accomplishments or stronger results.

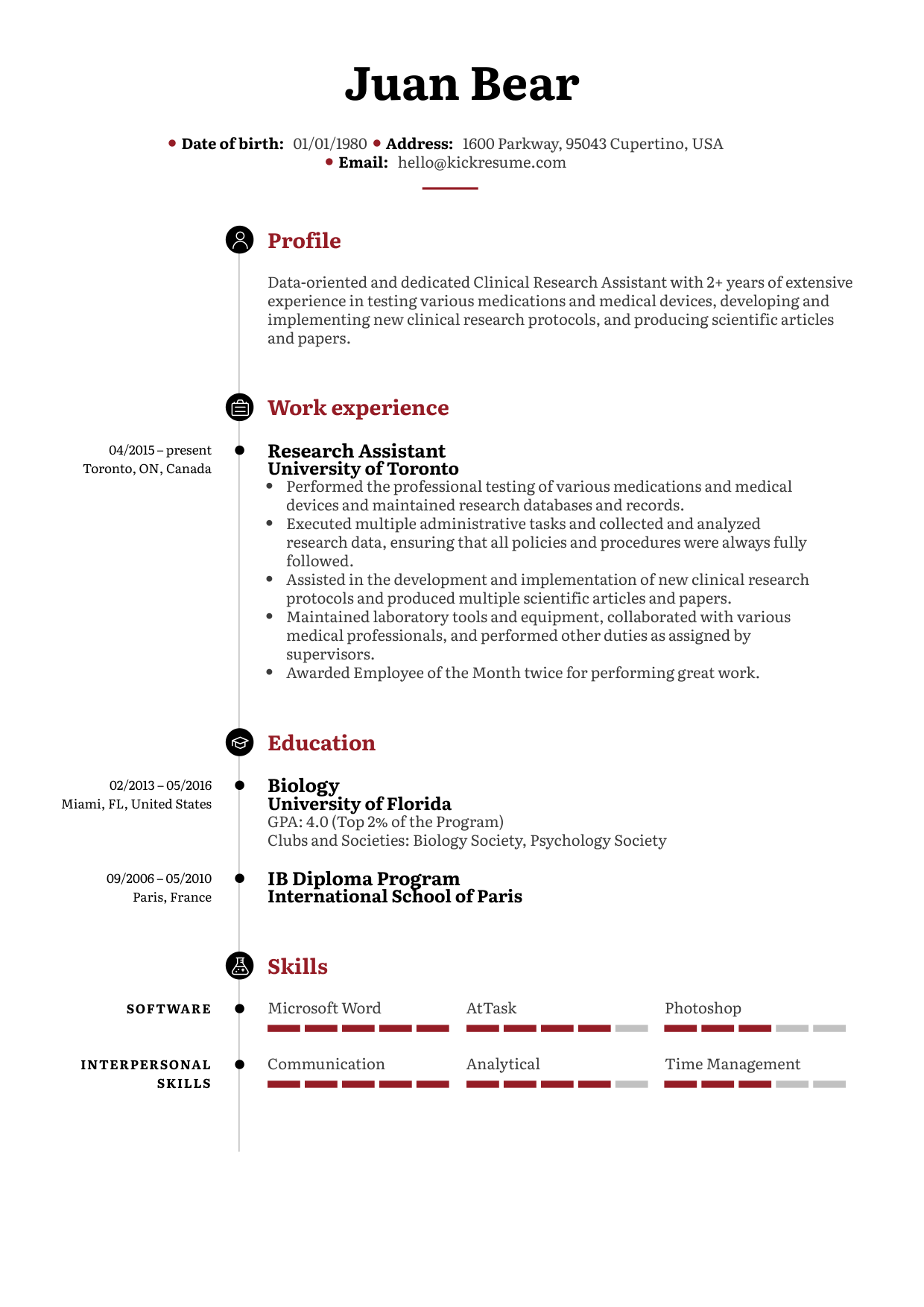

Bookkeeper resume example

Why does this resume example work?

- Impressive list of computer skills: The applicant names tools that matter in bookkeeping, like QuickBooks, Xero, NetSuite, and FinancialForce. These are the programs employers expect a bookkeeper to know, so pointing them out directly helps the reader trust that the applicant can step in without a long learning period. It also matches well with the tasks listed previously in the experience section, which makes the whole resume feel more connected.

- The language section adds extra value: Being able to work in French, English, and Spanish is a solid advantage in any financial role, especially for employers who deal with international clients. It tells the employer that the applicant can handle communication, documentation, and client issues in more than one language. This is something that often sets one resume apart from another in a crowded field.

Is there a way to do it a little better?

- The resume would be stronger with some numbers: Most of the tasks are listed clearly, but none of them explain the impact of the applicant’s work. A few numbers could make a big difference. For example, improving processing time, reducing errors, cutting costs, or handling a specific volume of invoices each month would tell the employer exactly how effective the applicant was. Quantifying work turns a basic duty into a real accomplishment.

- The profile could be more straightforward: The profile sounds confident, which is great, but it relies a lot on descriptive words instead of concrete examples. The applicant could replace some of the broad claims with one or two specific highlights. Something like improving a reporting process or supporting a financial transition would feel more grounded and easier for a recruiter to trust.

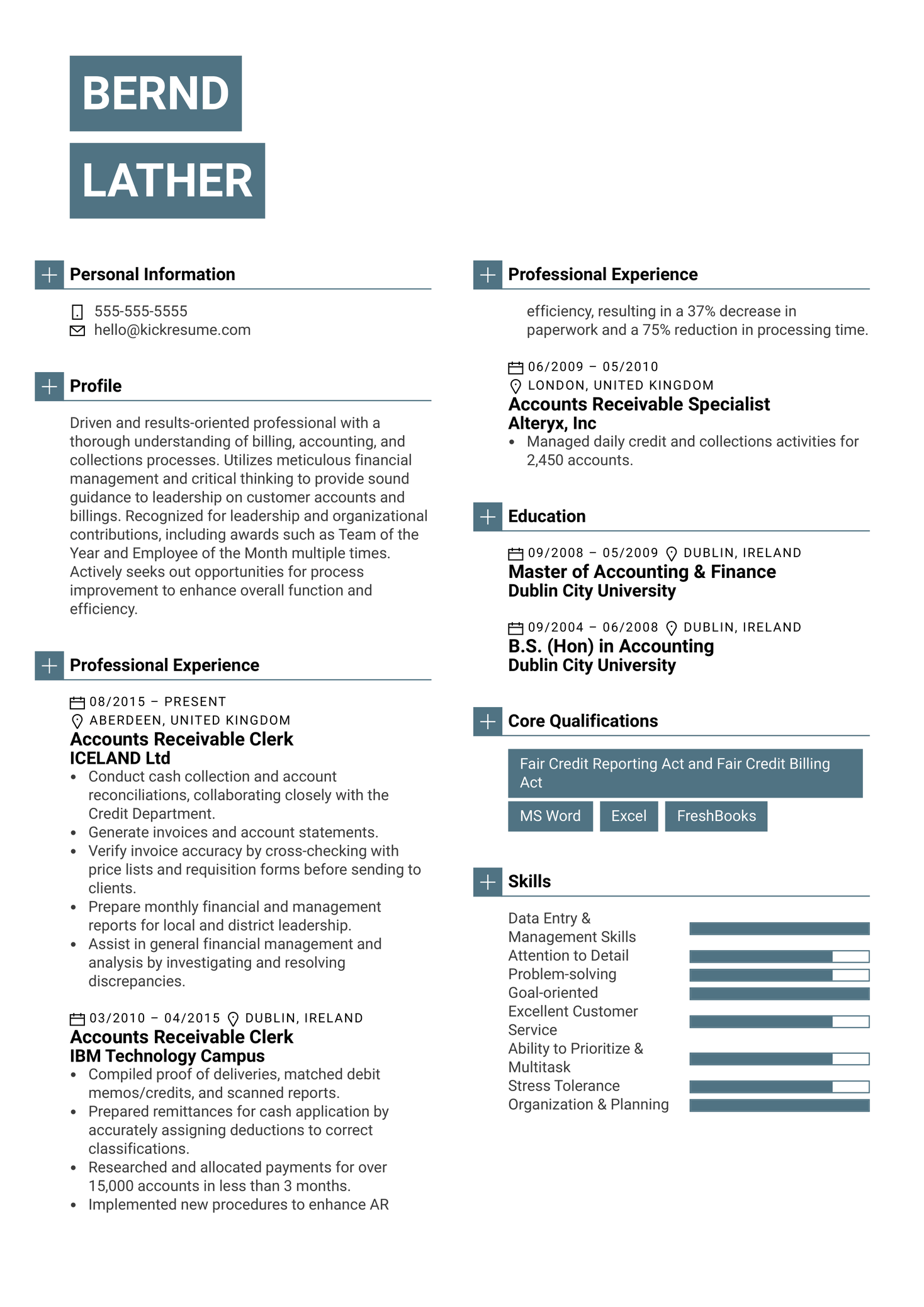

Accounts receivable clerk resume example

Why does this resume example work?

- The experience section shows steady growth: The applicant has stayed in the same field for many years and worked in well known companies. That kind of continuity is helpful for a hiring manager because it shows the applicant has real depth in accounts receivable work. It also makes it easier for someone reviewing the resume to follow how their responsibilities expanded over time.

- The core qualifications are targeted and useful: Mentioning knowledge of the Fair Credit Reporting Act and Fair Credit Billing Act is a nice detail. These laws matter in day to day AR work, so listing them helps the applicant stand out. Adding specific software like FreshBooks and Excel also gives the employer confidence that the applicant can handle common tools without training from scratch.

Is there a way to do it a little better?

- The skills section could be trimmed and grouped more tightly: Some of the skills overlap, like organization, planning, and ability to prioritize. These could be combined or replaced with something more specific to AR work. When a resume lists too many soft skills in a row, it starts to feel like filler even if they are all true.

- The awards would stand out more in their own section: Right now, the applicant mentions winning Team of the Year and multiple Employee of the Month awards in the profile, but those details get a little buried. If they were moved into a small awards section, they would pop off the page and instantly signal strong performance. Hiring managers skim, and giving achievements their own space makes them much harder to miss.

1. Proper format for your bookkeeper resume

The format of your resume can significantly impact how easily employers can digest your information. Let's take a look at the three main types: chronological, functional, and hybrid.

- Chronological format: A chronological format lists your work history in order, starting with the most recent. It's great for showing a clear career progression, especially if you've got a stable work history in bookkeeping.

- Functional format: A functional format, on the other hand, emphasizes your skills more than your work history. If you're changing careers or have gaps in your employment, this might be the way to go.

- Hybrid format: A hybrid format meshes the other two, balancing focus between skills and work history. It's useful if you're aiming to highlight specific skills while also showcasing chronological work experience.

When choosing a format, consider your work history, the role you're applying for, and the company's expectations. Each format has its strengths, and choosing the appropriate one can significantly enhance your bookkeeper resume's impact.

2. Effective bookkeeper resume summary or objective

The resume summary, although brief, is instrumental in establishing a strong, professional image. For bookkeeping roles specifically, it should include:

- Your number of years in the field: This communicates your level of experience directly.

- Areas of proficiency: Clearly state your expertise, such as in tax preparation, financial analysis, or software competency.

- Significant achievements: If you've streamlined processes, saved costs or improved efficiency, say it here.

Bad bookkeeper resume summary example

Bookkeeper with skills in QuickBooks

Why is this example incorrect? It’s simply too vague. It doesn't specify the total work experience, areas of proficiency or any achievements. Moreover, it doesn't demonstrate how the candidate can add value to the company.

Good bookkeeper resume summary example

Seasoned bookkeeper with 7+ years of experience, proficient in financial reporting, payroll management, tax preparation, and QuickBooks. Increased overall accounting efficiency by 30% in my last role.

Why is this example correct? This resume summary displays the candidate's experience, areas of proficiency, and a quantifiable accomplishment, thereby painting a complete, informative picture of the candidate's potential value to the employer.

But what if you’re fresh out of school?

Even if you have no real-world experience, fret not. Instead of a professional summary, which leans on experience, it's entirely appropriate to write a resume objective. A resume objective focuses more on your career goals and explains to potential employers how your skills and knowledge make you a fit for the role.

A common mistake is to be too generic or self-focused:

Bad resume objective example

A recent graduate seeking a challenging bookkeeper role to kickstart my career.

Why is this example wrong? This statement concentrates solely on what the applicant wants, rather than expressing how the company can benefit from their skills and competencies.

A well-crafted resume objective clearly articulates your skills, how they tie in with the role, and what you intend to accomplish:

Good resume objective example

Customer-focused accounting graduate with a certification in QuickBooks, seeks to utilize strong numerical and analytical skills as a Bookkeeper at XYZ Company. Aiming to assist with accurate record keeping and contribute to financial efficiency.

Why is this example correct? This bookkeeper resume objective focuses on how the applicant's skills can benefit the employer, demonstrating a proactive mindset.

To wrap it up, whether you're an experienced bookkeeper summarizing your career highlights or a recent graduate outlining your career objective, the goal is to tie your unique skills and experiences to the needs of the employer. A well-written summary or objective can quickly grab their attention and encourage them to keep reading.

3. Best skills for your bookkeeper resume

The skills section of your bookkeeper resume shines a light on your abilities and knowledge. They can be divided into two groups: hard skills, which are your technical knowledge or abilities specific to the job, and soft skills, which are your personal attributes or how you work.

In bookkeeping, both hard and soft skills play a vital role. Hard skills might showcase your ability to use bookkeeping software or prepare financial reports, while soft skills can demonstrate your attention to detail or strong organizational abilities.

Remember to scan the job ad carefully and place those required skills at the top of your list. This simple strategy helps you stand out, as hiring managers and automated tracking systems are likely to search for these particular skills first.

Here are some examples of skills to include in your bookkeeper resume:

The best hard skills for a bookkeeper resume

- Proficiency in QuickBooks, Xero, or other accounting software

- Budgeting and forecasting

- Payroll management

- Financial reporting

- Tax preparation

- Accounts payable and receivable

The best soft skills for a bookkeeper resume

- Exceptional attention to detail

- Strong organizational skills

- Communication skills

- Time management

- Ethical behavior

- Problem-solving abilities

In conclusion, your skills section should highlight your relevant hard and soft skills. Tailoring this section to match the job description not only demonstrates your fit for the role but also makes your bookkeeper resume more appealing to both hiring managers and ATS.

4. Strong work experience and key projects section for your bookkeeper resume

Your work experience and key projects section is where you get to display, in pragmatic terms, what you've accomplished in your career so far. It's crucial to present this information succinctly and effectively using bulleted lists, strong action verbs, and engaging adjectives.

Each bullet point should begin with a verb indicating what you did, followed by the task performed, and ideally, the positive result or outcome. Remember to highlight achievements instead of mere job descriptions and to quantify your achievements wherever possible.

Here's a mini-list of active verbs and adjectives for this section

- Coordinated

- Managed

- Analyzed

- Improved

- Accurate

- Efficient

- Detail-oriented

- Comprehensive

Let's examine one incorrect and one correct example:

Bad work experience and key projects section example

Bookkeeper at XYZ Company

January 2015 - December 2020

- Handled bookkeeping duties

- Assisted in payroll activities

- Helped prepare tax returns

- Participated in preparing monthly financial reports

- Managed accounts payable and receivable

Key Project

- Assisted in the year-end financial audit

Why is this example wrong? It definitely lacks detail and impact. It fails to specify the skills used, the scope of tasks, and the tangible outcomes from your work. It merely tells the reader that you were present and participating, without showcasing any achievements or the value you brought to the role.

Good work experience and key projects section example

Senior Bookkeeper, XYZ Company

January 2016 to December 2020

- Managed comprehensive bookkeeping operations, improving overall efficiency by 20%

- Coordinated end-to-end payroll administration for 150+ staff members

- Analyzed monthly financial statements and reports, leading to better decision-making

- Executed accurate accounts payable and receivable processes

- Streamlined the tax preparation process, resulting in 15% cost savings annually

Key Project

- Spearheaded a successful financial audit for the year 2019-2020, resulting in 0 discrepancies

Why is this example correct? It paints a specific picture of your responsibilities, skills used, and positive outcomes. It also clearly highlights a key project you led, showing your initiative and positive contributions to the company.

When detailing your work experiences and key projects, aim to demonstrate the impact you made. Quantify your performance where possible and emphasize any projects where your skills brought value to the company. So, choose your words carefully and make sure to shed light on those standout bookkeeping moments that define your career.

5. Effective bookkeeper resume education section

The education section of your bookkeeper resume plays a vital role. Even though bookkeeping is a hands-on job, employers might favor candidates who have formal education in related fields. It shows you've learned the foundations of accounting and finance.

If your degree is in a related field, list it along with any relevant courses and academic achievements. This gives employers insight into your proficiency in the field.

Bookkeeper education section example

Bachelor of Science in Accounting

XYZ University, 2016-2020

- Courses: Fundamentals of Bookkeeping, Advanced Financial Accounting

- Achievements: Graduated Cum Laude, Awarded 'Best Accounting Project' for an efficient budgeting model

But what if your degree is in an unrelated field? It's often helpful to list any relevant courses or projects you've completed — this can happen inside or outside of formal education. Remember to include your academic achievements too.

Bookkeeper education section example (no related background)

Bachelor of Arts in English

XYZ University, 2015-2019

- Relevant coursework: Introduction to Finance, Business Administration

- Project: Oversaw budget planning for Student Council events

Regardless of your background, listing your education provides a fuller picture of your qualifications. Despite field relevance, any additional coursework or projects related to bookkeeping help to cement your credibility as a candidate.

6. Relevant extra sections for your bookkeeper resume

While the core sections we've discussed so far form the backbone of your bookkeeper resume, additional sections can further enhance your profile based on their relevance to the role and your personal strengths. These can highlight diverse experiences that may set you apart from other candidates. Here are some examples of extra sections for you to consider:

- Volunteering: If you've done any voluntary work related to finance or bookkeeping, this can be a valuable addition. It demonstrates your dedication and practical experience.

- Certifications: If you have any certificates in accounting or bookkeeping software, don't hesitate to list them. These prove you have industry-recognized skills, and could potentially leave a strong impression.

- Languages: If you know any languages other than English, do include them. This could potentially be a valuable asset in a diverse workplace or if the company deals with international clients.

Here’s how you can list your extra sections

Volunteer activities

- Volunteer Bookkeeper, Local Charity Organization 2019-Present: Manage financial records and reports, helping the organization keep track of its funding

Certifications

- Certified QuickBooks ProAdvisor, 2020*

Languages

- Spanish: Full proficiency

- English: Full proficiency

- German: Native

While we've pointed out three potentially useful extra sections, there's no limit to what you can include in your bookkeeper resume. The guiding principle is relevance.

For instance, you could add a "Memberships" section if you're part of professional accounting or bookkeeping organizations. A "Conferences" or "Continuing education" section could highlight any industry events you've attended or courses you've taken to stay ahead of the curve.

Whatever you decide to include, remember to ask yourself: “Does this add value to my application? Does it underline my capability or commitment as a bookkeeper?” If the answer is yes, then it’s worth including that extra section.

7. When to include a bookkeeper cover letter

A cover letter can be a vital addition to your bookkeeper resume. Though they both contribute to your job application, the resume and cover letter serve different purposes and offer distinct information:

- Your resume is a factual, chronological snapshot of your skills, work experience, and education. It provides a quick basis for employers to evaluate your qualifications for the job.

- On the other hand, a cover letter is more personal and narrative. It's your chance to explain, in your own words, why you’re interested in the role and how your background makes you an ideal fit. It provides context to your resume, letting you highlight specific experiences or projects and how they have prepared you for the role.

So, when to include your bookkeeper cover letter? It surely depends on the job application requirements. If a job ad asks for one, it's essential to include it. Even if it's not requested, providing a well-constructed cover letter can help set you apart. It shows initiative and gives the employer additional insight into your skills and motivations.

In summary, while your resume presents the "what" and "how" of your professional journey, your cover letter communicates the "why." Having both gives you a better chance of reconnecting with the hiring manager, solidifying your suitability for the role.

8. Bookkeeping resources

When preparing your bookkeeper resume, it's essential to have the right tools at your fingertips. Here are some top resources for future bookkeepers:

- Educational websites: Websites like Coursera and EdX offer online courses in bookkeeping. They can bolster your knowledge, which can then be added to your resume.

- Professional organizations: Joining groups such as the American Institute of Professional Bookkeepers can provide networking opportunities and additional resources.

- Industry-specific publications: Regular reading of industry magazines like The Journal of Accountancy keeps you updated with the latest news.

- Software training: Familiarity with software like QuickBooks, Zoho Books or Sage is highly attractive to employers. Many have online tutorials to improve your skills.

- Career consultation services: Career coaches or mentors can guide you to hone your career path and resume.

Remember, showcasing your commitment to continuous learning and professional growth in your bookkeeper resume ticks a vital box for potential employers. Keep seeking knowledge, stay up-to-date, and you'll always have an edge in your career.

9. Average salary and outlook for bookkeepers

The financial industry continually evolves, and so does the role and prospects for bookkeepers. According to the most recent data from the Bureau of Labor Statistics, the average annual salary for bookkeepers was $45,860 in May 2022.

However, employment of bookkeeping, accounting, and auditing clerks is projected to see a decline of about 6% from 2022 to 2032. This reduction might be attributed to technological developments that have automated certain tasks once done by bookkeepers.

Nevertheless, it's not all daunting news for aspiring bookkeepers. Even with this anticipated decline, there are still opportunities. In fact, an average of approximately 183,900 job openings per year for bookkeeping, accounting, and auditing clerks are projected over the next decade.

All in all, despite the evolving landscape, the field of bookkeeping remains an integral part of businesses. While there's an expected dip in overall employment, opportunities for skilled bookkeepers continue to emerge, serving as a testament to their enduring importance in the financial sector.

Accounting / Finance Career Outlook in 2026

Between now and 2034, the accounting field is projected to see 5% growth while finance occupations are expected to grow by 6%. Both rates outpace the national average for all occupations. (Source: U.S. Bureau of Labor Statistics).

On top of that, employers are expected to post about 124,200 accounting openings and 29,900 finance openings each year, largely due to business growth and normal turnover (like retirements and role changes).

According to The World Economic Forum’s report, some traditional accounting roles may decline as automation spreads, but the upside is clear: demand will stay strong for accountants and finance professionals who can use AI and tech tools to work faster, deliver better insights, and support decisions.

Average US base salaries across popular Accounting / Finance roles:

- Accountant: $67,624/year

- Auditor: $93,976/year

- Bookkeeper: $65,719/year

- Financial Analyst: $81,598/year

- Insurance Agent: $74,701/year

- Investment Advisor: $86,320/year

- Tax Services: $73,546/year

These salary estimates come from Indeed (as of January 2026), and are based on anonymous submissions from workers, along with salary data from job postings on the platform over the last 36 months. Exact figures vary by location, company size, and experience level.

Still, if you’re entering accounting or finance, or looking to grow, the field is opening up, especially for people who can pair finance skills with modern tools.

Bookkeeper Resume FAQ

Can I include part-time or internship experience in my bookkeeper resume?

Absolutely. Part-time jobs, internships, and even relevant volunteer work can demonstrate your skills and commitment. Be sure to highlight major responsibilities and achievements in these roles.

What if I have a gap in my employment history?

It's best to be honest about any gaps. You can explain them in your cover letter or during the interview. Often, employers value what you did during the gap, such as taking a course or volunteering.

Should I list all of my previous jobs?

Generally, you should list your most recent and relevant work experiences. If older jobs aren't relevant to the bookkeeping position you're applying for, you can leave them out.

How long should my bookkeeper resume be?

Your resume should be as concise as possible while still detailing your qualifications. For most candidates, a one-page resume is sufficient. If you have extensive experience, two pages may be necessary.

Can I include references on my bookkeeper resume?

It's generally recommended to leave off references and instead provide them upon request. This can save valuable space for other important information.

![How to Write a Professional Resume Summary? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/How_to_Write_a_Professional_Resume_Summary_.png)

![How to List Your Education on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/How_to_Put_Education_on_a_Resume_.png)

![How to Describe Your Work Experience on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/How_to_Describe_Your_Work_Experience_on_a_Resume_.png)