If you're under the impression that crafting the perfect risk manager cover letter is difficult, let us prove you wrong!

Sure, putting together a job winning application includes quite a bit of effort and time. But with the right instructions, the whole process runs much smoother. And that's where our comprehensive guide, packed with the best writing tips, customizable templates, real-life cover letter samples, and detailed examples, enters the scene!

Keep reading to learn:

- What works and what doesn't in risk manager cover letters

- How to format your risk manager cover letter properly

- How to create a structured risk manager header

- How to write a professional risk manager cover letter headline

- How to tailor your risk manager cover letter for a specific position

- How to write a personalized cover letter greeting

- How to catch an employer’s attention with your risk manager introduction

- Which skills & accomplishments to showcase as a risk manager

- What are action verbs and how to use them in your risk manager cover letter

- How to end your risk manager cover letter with a persuasive conclusion

- Which mistakes to avoid when creating a risk manager cover letter

- How to create a cohesive job application with cover letter and resume templates

- Where to find top resources for job-seeking risk managers

Still on a job hunt? Our thorough and detailed cover letter and resume articles and career tools will help you get hired fast.

Financial risk analyst cover letter sample

Why this cover letter works

- Connects strategy with risk-oriented analysis: Shows awareness of business performance, decision-making, and uncertainty. Those are all relevant to risk roles.

- Strong business context & cross-functional exposure: Demonstrates collaboration with multiple departments, which is highly valued in strategic + risk environments.

- Shows initiative and ambition: Tone suggests proactive contribution rather than passive execution, which stands out at analyst level.

What could be improved

- Lacks measurable impact: Would benefit from metrics that quantify efficiency gains, forecasting accuracy, or strategic results.

- Missing technical stack: No mention of analysis tools, modeling software, or data platforms, which are important signals for Risk/Strategy hiring pipelines.

- Could better connect to employer-specific context: Tailoring to the company’s industry, regulatory environment, or strategic priorities would make it stronger.

Risk analyst cover letter sample

Why this cover letter works

- Strong credentials up front: Mentions a relevant master’s degree and certification early, signaling both domain knowledge and professionalism.

- Shows impact with numbers: Highlights a concrete financial outcome ($1M reduction in liability claims), which immediately quantifies value.

- Clear explanation of core responsibilities: References tasks like identifying risks, implementing models, and preparing reports are all directly relevant to the Risk Manager role.

What could be improved

- More tailoring to the employer: The letter explains interest in the role but doesn’t connect to the company’s specific risk profile, industry, or challenges.

- More detail on risk methods & tools: Mentioning frameworks, methodologies, or analytical tools (e.g., VaR, Basel III, SQL, Python, dashboards) would make it more competitive.

- Stronger structure for readability: Dense paragraphs could be broken into more scannable bullets or shorter lines, especially for achievements and key skills.

Strategy analyst cover letter sample

Why this cover letter works

- Connects strategy with risk-oriented analysis: Shows an understanding of how strategic insights overlap with risk thinking, which is useful for roles where strategy and risk assessment intersect.

- Strong business context & collaboration: Highlights work in terms of company initiatives and cross-functional teamwork, demonstrating real-world business impact.

- Shows initiative and proactivity: The tone suggests the candidate contributes to shaping insights and outcomes, not just executing tasks, and that is a key differentiator at analyst level.

What could be improved

- Needs measurable impact statements: Specific metrics (e.g., efficiency improvements, forecast accuracy, execution timelines) would make achievements more concrete.

- Missing technical/analytical tools: Adding proficiency with tools (Excel, SQL, Python, Tableau, Power BI, etc.) would better signal readiness for data-driven risk/strategy roles.

- Could tie more directly to risk concepts: One or two sentences explicitly connecting strategy work to risk evaluation (scenario analysis, regulatory considerations, competitive risk) would strengthen relevance for risk-adjacent hiring managers.

1. How to format your risk manager cover letter the right way

Risk roles sit at the intersection of analysis, precision, and communication, and the formatting of your cover letter should reflect that. If the document looks cluttered, chaotic, or amateur, it can subconsciously signal the opposite of what risk managers are hired for: clarity, structure, and control.

The goal isn’t flashy design. It’s easy readability, clean hierarchy, and information that can be scanned in seconds. If you need a deeper walkthrough of structure, you can also check our full guide on how to write a cover letter.

Here’s how to format a risk manager cover letter properly:

- Stick to clean, business-appropriate fonts: Calibri, Arial, Helvetica, or Times New Roman work well.

- Use a standard readable size: 11–12 pt for body text, and slightly larger for your name or section headers.

- Maintain balanced margins (~1 inch): It avoids overcrowding and keeps the page visually organized.

- Structure into short paragraphs: Risk hiring managers don’t want to decode walls of text, therefore, one point per paragraph is ideal.

- Left-align everything: It’s the most professional and easiest alignment to skim.

- Keep the length to one page: Typically 4–6 brief paragraphs is the sweet spot for concise communication.

- Use bold only for clarity: Reserve bold for section labels or important names, not for stylistic emphasis.

- Leave space to breathe: White space immediately increases professionalism and improves comprehension.

If you'd like to skip all this formatting stuff, a professional cover letter template (or Kickresume’s AI Cover Letter Writer) can help you save valuable time, especially if you’re applying to regulated, compliance-driven, or corporate environments where presentation matters.

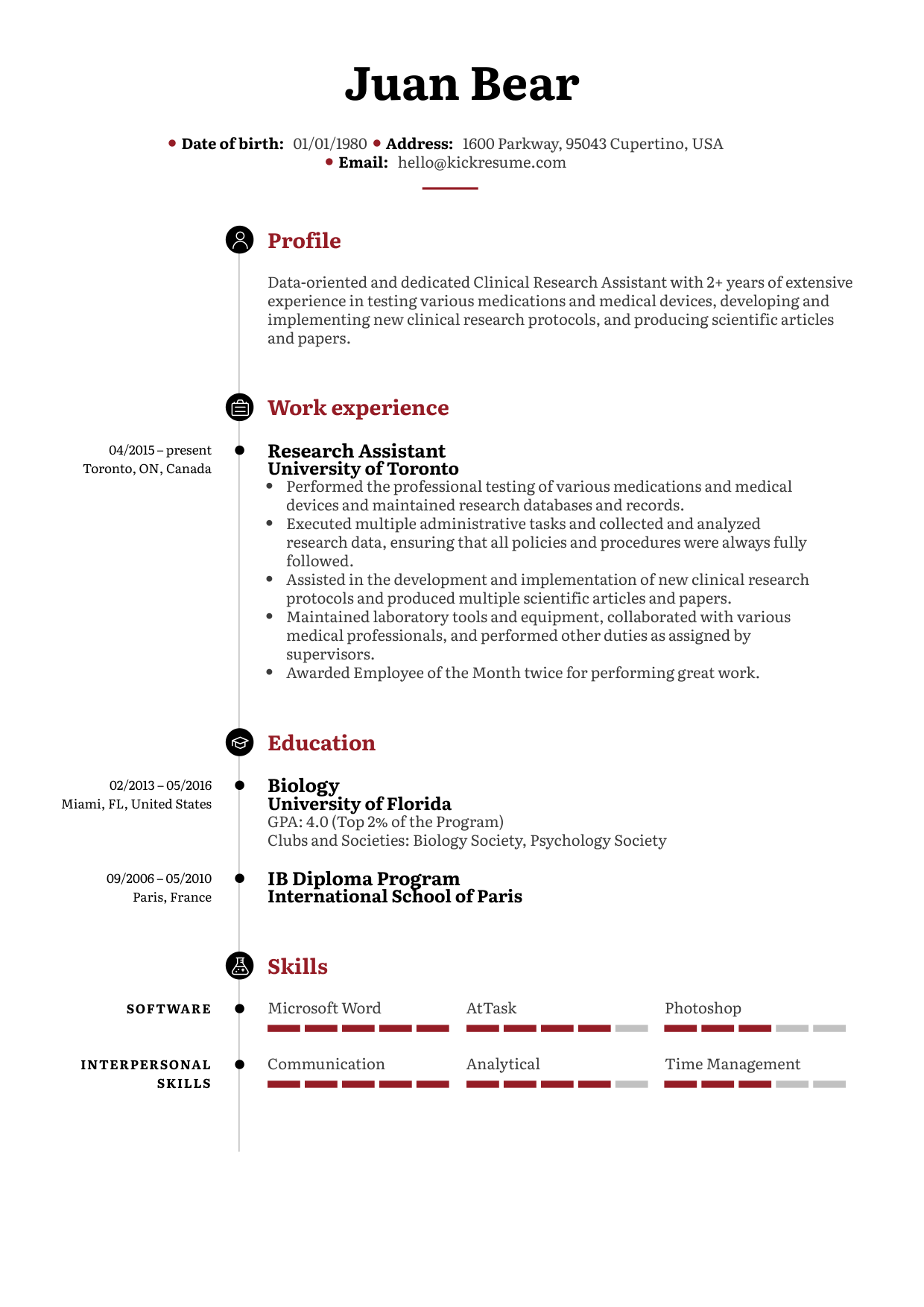

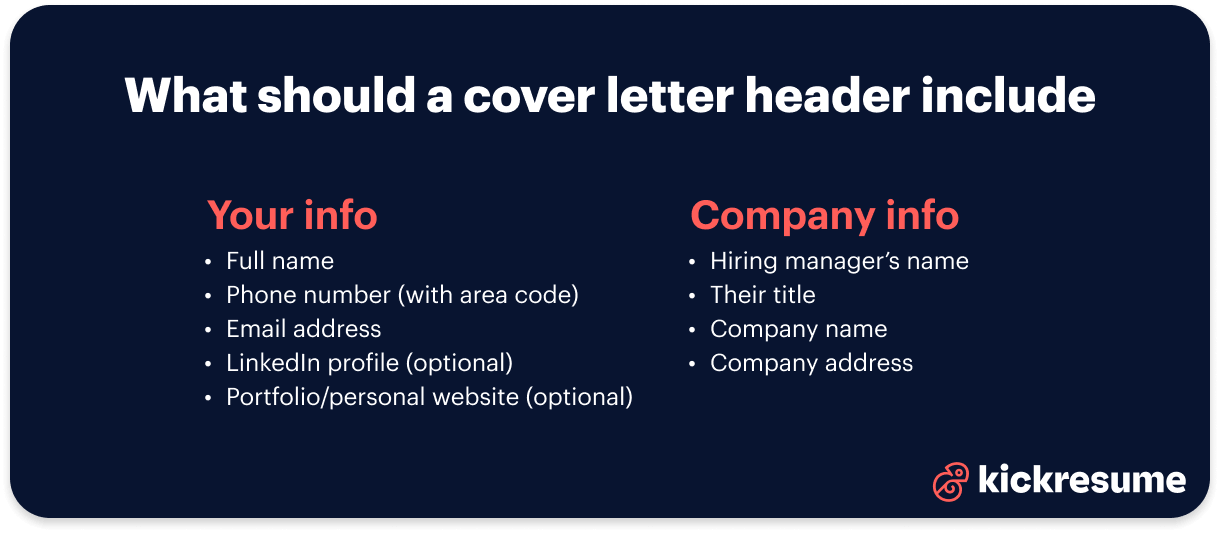

2. How to create a structured risk manager header

Before a recruiter reads a single sentence of your cover letter, they notice how it looks.

In risk management roles, where structure, clarity, and attention to detail are essential, a poorly formatted header can quietly undermine an otherwise strong application. Your header sets expectations about how professionally you approach documentation and communication.

A strong cover letter header should be clear, consistent, and easy to scan.

What to include in your risk manager cover letter header

Your header should contain the following information:

- Your full name and professional title (e.g. Risk Manager, Senior Risk Analyst, Enterprise Risk Manager)

- Your professional contact details (email address, phone number, LinkedIn profile)

- The name of the company and relevant department you are applying to

- The company’s address (optional, but still common in more formal applications)

Good risk manager cover letter header example

Maxwell Johnson, Risk Manager

(123) 456-7890 | maxjohnson@email.com | linkedin.com/in/max-johnson

To: Longville Dynamic Business Solutions

Risk Management Department

1234 Street Address

Nashville, TN 37011

Why this works: This header is formal without feeling outdated. All essential information is immediately visible, and the structure aligns with expectations in corporate and regulated environments, where clarity and consistency matter.

Mistakes to avoid when writing a cover letter header

- Using casual or unclear job titles

- Including unnecessary personal information (photo, date of birth, marital status)

- Formatting the header differently from your resume

Pro tip

Your resume and cover letter headers should look identical in structure and styling. This visual consistency signals professionalism and attention to detail — two qualities hiring managers expect from risk professionals.

3. How to write a risk manager cover letter headline that adds value

Most candidates skip the headline entirely, and that’s exactly why it works when you include one.

A cover letter headline is a short, one-line statement placed directly under your header. Its purpose is to give recruiters instant context about who you are, what you specialize in, and why your application is worth reading.

Think of it as a clear, professional label, not a slogan.

What makes a strong risk manager cover letter headline?

An effective headline typically includes:

- A keyword related to the role (risk management, enterprise risk, compliance, security)

- A number or trigger phrase that adds specificity

- A strong verb or adjective that signals impact

- A promise that the cover letter is tailored to the employer

Good risk manager cover letter headline example

My 4-Step Approach to Risk Management & How It Will Ensure the Security of Your Business

Why this works:

- It’s specific rather than generic

- It clearly references risk management

- It focuses on employer value, not just the candidate

Weak risk manager cover letter headline example

Application for Risk Manager Position

Why this doesn’t work:

- It adds no new information

- It simply repeats what the recruiter already knows

- It wastes valuable space that could be used to differentiate you

Headline examples for entry-level or early-career risk professionals

If you’re earlier in your career, your headline can focus on education, analytical strengths, or hands-on exposure rather than seniority:

Good cover letter headline examples for an entry-level risk manager role

- Risk Management Graduate with Strong Exposure to Regulatory Analysis and Risk Assessment

- Junior Risk Analyst with Experience in Operational and Compliance Risk Evaluation

These headlines still provide useful context while staying accurate and realistic.

Final note on headlines

- You don’t need to sound clever or overly creative.

- You need to sound clear, relevant, and intentional.

In risk management, a good headline quietly communicates that you understand structure, priorities, and business impact, even before the first paragraph begins.

4. How to tailor your risk manager cover letter for a specific position

Tailoring your cover letter is an important step in the writing process.

By tailoring your cover letter for the exact position you're applying for, you not only show the employer that you have excellent attention to detail but also that you have put extra effort into your application.

A tailored risk manager cover letter shows two critical things hiring managers care about:

- Attention to detail, which is non-negotiable in risk roles

- Intentionality, meaning you didn’t apply blindly but understand the business context

In risk management especially, generic applications stand out in the wrong way. Employers expect candidates to think contextually, for example about industry exposure, regulatory environment, and business priorities.

What to research before you write

Before you start writing (or editing) your cover letter, spend a few minutes researching:

- The company’s current goals, strategy, or transformation efforts: growth phase, digitalization, M&A, regulatory expansion, etc.

- The types of risks the company likely faces daily: regulatory, operational, financial, cybersecurity, third-party, market risk

- The organizational setup of risk management: centralized vs decentralized, risk ownership, reporting lines

- The person or team reviewing applications, if available

Even referencing one of these elements in your letter makes it feel intentional rather than mass-produced.

5. How to write a cover letter greeting to address the reader correctly

A greeting is a crucial part of your cover letter. If written correctly, you can immediately appeal to the reader. But if you address the reader incorrectly, things might go south pretty quickly from here.

If the job posting, company website, or LinkedIn reveals the hiring manager’s name, always use it.

If you know the name

Good examples of personalized greetings

- Dear Executive Manager Jane Doe,

- Dear Mrs. Jane Doe,

- Dear Ms. Jane Doe & the Strategic Development Team,

This immediately signals professionalism and effort.

If you don’t know the name (very common)

Not knowing the hiring manager’s name is normal, and guessing is worse than being general.

Use a role-based or team-based greeting instead of outdated or vague options.

Good alternatives when the name is unkown

- Dear Risk Management Team,

- Dear Hiring Manager,

- Dear Risk & Compliance Team,

- Dear Head of Risk Management,

- Dear Strategy & Risk Leadership Team,

These options:

- Still feel targeted

- Avoid sounding lazy or impersonal

- Respect professional hierarchy

Bad examples of cover letter greetings

- To Whom It May Concern

- Dear Sir or Madam

- Guessing the name

These greetings sound outdated, detached, generic, and impersonal. And the worst of all if you guess the name incorrectly, it may damage your credibility immediately.

Quick rule of thumb

If you don’t know the person’s name, address the function, not the void.

Risk managers are hired by teams and leaders, not by “whomever.”

Why a greeting matters in risk roles

Risk management is built on:

- Precision

- Accountability

- Context awareness

How you tailor your greeting and opening lines already shows whether you think like a risk professional — before the recruiter even reaches your experience section.

A well-targeted greeting sets the tone for everything that follows.

6. How to hook an employer’s attention with your risk manager introduction

Your header, headline, and personalized greeting work together to spark initial interest.

But it’s your introduction paragraph that decides whether the recruiter keeps reading, or skims ahead.

A strong risk manager cover letter introduction should do three things quickly and clearly:

- Establish credibility: Briefly summarize your professional background (years of experience, industry focus, risk specialization).

- Show intent: Explain why you’re applying for this specific role at this company, not just “a risk manager position.”

- Build trust (when possible): Mention a mutual acquaintance or referral to immediately increase credibility.

Pro tip

If you can reference a mutual contact, do it. Referrals act as a trust shortcut for hiring managers.

If you don’t have one, use LinkedIn to research the company, connect with employees, or identify shared professional networks. Even light networking can strengthen your introduction.

Bad risk manager cover letter introduction example

Dear Hiring Manager,

I am writing to apply for the risk manager position at your company. I have experience in risk management and believe my skills would be a good fit for your organization. I am looking for a new opportunity where I can grow professionally and contribute to your success.

Why doesn’t this work?

- It’s generic. This paragraph could be sent to any company in any industry.

- It focuses on what the candidate wants, not on the employer’s needs or context.

- There’s no indication of specialization, impact, or motivation beyond job searching.

Good risk manager cover letter introduction example

Dear Executive Manager Jane Doe,

I am a risk management professional with 10+ years of total experience and more than 5 years of specialized experience working in FinTech. After learning about your company’s focus on scalable financial platforms, I reached out to your assistant manager, Mr. Jack Smith, to better understand the direction of your risk management function. After reviewing my background, Mr. Smith encouraged me to apply, believing my experience in regulatory risk and operational resilience aligns well with your current priorities.

Why does this work?

- It establishes seniority and specialization immediately (FinTech + risk focus).

- It clearly explains why this company is attractive to the candidate.

- The referral adds instant credibility and context, not just name-dropping.

A quick guideline to follow

If your introduction could be copy-pasted into another application without changes, it’s probably too weak.

Aim for an opening that answers this silent recruiter question within the first few lines:

“Why should I trust this person with risk in our organization?”

When you get the introduction right, everything that follows feels more convincing.

.png)

7. Which relevant skills & accomplishments to showcase as a risk manager

With your introduction in place, it’s time to divulge greater details about your best and most relevant skills and accomplishments as a risk manager.

As you describe these skills and accomplishments, make sure the information you include is as specific, contextual, and quantifiable as possible. Remember that these details help to show an employer the real-life value you have to offer, so make them count.

Here are 6 examples of skills to describe in your risk manager cover letter

- Identifying business risks (financial risks, security risks, etc.)

- Developing action plans to minimize risk

- Working with insurance departments or companies

- Gathering and analyzing business data

- Knowledge of financial regulations and compliance requirements

- Developing risk management budgets

Good risk manager cover letter accomplishment example

As the primary risk manager at [Former Employer], I worked closely with financial experts to determine potential security risks when dealing with sensitive customer data. After identifying a major security problem in the company’s digital platform, I implemented a risk mitigation solution that reduced the security risk by 85%.

.png)

8. How to strengthen your risk manager cover letter with action verbs

Word choice carries more weight in analytical roles than most candidates expect. The action verbs you choose can signal confidence, ownership, and clarity. Those are three qualities hiring managers look for in risk professionals.

Compare vague phrasing like “I was responsible for supporting risk reporting” with a statement that shows initiative and impact. Action verbs shift your writing from passive descriptions to purposeful contributions, and risk hiring managers notice that instantly.

See how action verbs change perception

Before including action verbs

I was responsible for supporting risk reporting.

After including action verbs

I produced and validated quarterly risk reports to support executive decision-making and regulatory compliance.

Same task. Entirely different impression.

What risk-related action verbs do well

For risk roles, choose verbs that communicate:

- analytical rigor

- decision support

- problem-solving

- cross-functional collaboration

- regulatory awareness

- accountability

These qualities closely reflect how risk actually operates inside a business.

Effective action verbs for risk manager cover letters

These verbs align especially well with operational, financial, credit, enterprise, and strategic risk functions:

Action verbs for risk manager cover letters

- Analyze

- Assess

- Evaluate

- Model

- Forecast

- Quantify

- Identify

- Mitigate

- Monitor

- Validate

- Escalate

- Recommend

- Implement

- Advise

- Collaborate

- Present

- Report

- Audit

- Enhance

- Ensure (compliance / accuracy / alignment)

- Develop (frameworks / controls / policies)

If used naturally, these verbs will make you sound like someone who participates in risk decisions instead of simply observing them.

Quick upgrade examples

Check the examples below and see how including action verbs changes the value of your text.

Example 1:

Before

I helped identify business risks.

After

I identified emerging operational risks and provided mitigation recommendations during quarterly reviews.

Example 2:

Before

I worked with the compliance department.

After

I collaborated with compliance teams to align risk controls with regulatory expectations.

Example 3:

Before

I was involved in risk modeling.

After

I developed scenario-based models to forecast exposures under varying market conditions.

A small note on balance

Risk roles require precision, so don’t turn every sentence into an aggressive verb sprint. The goal isn’t to sound flashy, but deliberate. Replace vague phrases where it improves clarity while keeping the narrative credible and grounded.

Pro tip for ATS screening

Many Applicant Tracking Systems scan for role-specific keywords like risk mitigation, compliance, controls, scenario modeling, or audit support. Pairing these skill keywords with action verbs can boost both ATS visibility and perceived competence.

.png)

Used thoughtfully, action verbs help your risk manager cover letter read as decisive, analytical, and impact-driven, and that is exactly what risk hiring teams want to see.

9. How to end your risk manager cover letter with a persuasive conclusion

Your conclusion is the last thing a hiring manager reads, and often the part that determines whether they take the next step or move on.

In risk management roles, a strong closing should reinforce three things:

confidence, professionalism, and follow-through.

A persuasive risk manager cover letter conclusion should include:

- A confident, forward-looking sentence expressing interest in the role

- Clear contact information or availability

- A polite indication of next steps or follow-up (without sounding pushy)

- A formal and professional sign-off

The goal isn’t to pressure the employer. It’s to make it easy and natural for them to continue the conversation.

Good risk manager cover letter conclusion example

As your new risk manager, I am confident I can help strengthen your organization’s approach to risk identification and mitigation. I would welcome the opportunity to discuss how my experience can support your business objectives. I am available for an interview at your convenience and can be reached at (123) 456-7890 between 9 a.m. and 5 p.m. I look forward to hearing from you and will follow up next week if I haven’t received a response.

Yours truly,

[Applicant Name]

Why this works:

- It reinforces the candidate’s value without repeating the resume

- It sounds confident but respectful

- It clearly states availability and next steps

The tone matches expectations for senior, corporate, and regulated roles

Bad risk manager cover letter conclusion example

Thank you for reading my cover letter. I really hope you will consider me for this position because I need a new job and believe I would be a good fit. Please contact me if you are interested.

Best,

[Applicant Name]

Why this doesn’t work:

- It focuses on the candidate’s needs instead of employer value

- It sounds uncertain and passive

- There’s no clear call to action or follow-up

- The tone feels informal and weak for a risk management role

Mistakes to avoid when writing a cover letter ending

- Ending too abruptly without signaling interest

- Sounding desperate or overly emotional

- Using casual sign-offs (“Cheers,” “Thanks,” “Best regards” in formal roles)

- Forgetting to include contact clarity or next steps

Final tip

In risk management, how you close your cover letter reflects how you close conversations, manage expectations, and follow through on responsibilities.

A calm, confident, and structured conclusion tells employers exactly what they want to hear:

this is someone who communicates clearly, plans ahead, and takes ownership.

10. Avoid these common mistakes in risk manager cover letters

Even highly qualified risk management professionals can undermine their applications with avoidable mistakes. Risk roles rely on judgment, communication, and analytical rigor, and hiring managers look for those traits in every part of the application, including the cover letter.

Below you'll find the most common pitfalls risk manager candidates run into, plus how to avoid them.

Mistake #1: Sending a generic, non-tailored cover letter

A cover letter that could be sent to any company in any industry signals low engagement.

How to fix it:

Reference something concrete about the organization: their sector (FinTech, healthcare, manufacturing, banking), regulatory environment, risk appetite, strategic initiatives, or industry challenges. Even one tailored sentence shows situational awareness and intentionality.

Mistake #2: Overloading the letter with buzzwords

Terms like risk mitigation, compliance, frameworks, analysis, or controls mean nothing without context.

How to fix it:

Transform jargon to real actions and outcomes, e.g., which frameworks (COSO, Basel III, ISO 31000), which data sources, which risk domains (credit, market, operational, cyber), and what results came out of the work.

Mistake #3: Focusing only on career goals instead of company value

A cover letter that’s all about advancement, learning, or “seeking new challenges” misses the mutual benefit.

How to fix it:

Explain how your analytical insight, frameworks, and decision support will help the company reduce exposure, improve controls, or support strategic planning. Show how your work impacts their bottom line, not just your career path.

Mistake #4: Repeating your resume in paragraph form

Listing risk duties without adding narrative context doesn’t strengthen your case.

How to fix it:

Use the letter to explain how you achieved results, why decisions mattered, or what business context you operated in. Risk work is rarely standalone, therefore show the strategic and operational implications.

Mistake #5: Ignoring cues in the job posting

Risk roles often specify technical expectations, frameworks, industries, or certifications. Skipping these signals makes candidates look misaligned.

How to fix it:

Mirror relevant terminology from the posting (e.g., “operational risk assessment,” “model validation,” “controls testing,” “credit risk exposure,” “compliance monitoring”), but only if truthful. This helps both ATS systems and human reviewers.

Mistake #6: Typos, vague language, or unclear phrasing

In risk management, precision matters. Poor writing raises legitimate concerns about analytical rigor and communication skills.

How to fix it:

Proofread thoroughly. Read the letter aloud to catch ambiguities. Use concise, data-driven language when possible.

Mistake #7: Weak or generic examples

Statements like “managed risks” or “supported compliance efforts” don’t show impact or scale.

How to fix it:

Be specific. Mention domains (financial, cyber, operational, strategic), stakeholders (executive leadership, regulators, finance), and measurable results when available.

Mistake #8: Forgetting to contextualize risk within business strategy

Risk exists to serve decision-making, not just documentation. Many applicants forget this.

How to fix it:

Briefly show how your work helped inform executive decisions, reduce uncertainty, increase resilience, or align with long-term strategy.

Small adjustments add up. Risk management is about clarity, judgment, and informed decision-making. Those are the traits your cover letter should communicate from the first sentence to the last.

If you’re preparing an application, take a final pass with these pitfalls in mind and don’t let preventable mistakes hold you back.

11. How to make your risk manager cover letter and resume work together

A strong application in risk management is never built on a single document. Your resume and cover letter play different roles: one lays out the facts, the other provides context and intent, and employers expect both.

Think of it like this:

Resume = Evidence

Titles, responsibilities, methodologies, tools, systems, frameworks, certifications, timelines, and measurable outcomes.

Cover letter = Interpretation

How you think, how you analyze, how you influence decisions, and why you’re a strong fit for that organization.

Together = Decision-making clarity

One proves capability. The other explains judgment, communication style, and alignment with the company’s risk environment.

When both pieces (in this case - documents) are aligned, it signals that you understand how risk functions within a broader business context, which is exactly what hiring managers look for.

How to create a cohesive job application set

You don’t need design skills to make your documents work together visually. Just focus on consistency:

- Match your contact details: Use the same name styling, phone, email, and LinkedIn across both documents.

- Use the same fonts and formatting conventions: A clean, readable font on the resume should be mirrored on the cover letter.

- Align spacing and structure: Consistent margins, alignment, and text spacing create visual cohesion and make your application easier to review.

- Utilize formatting elements subtly: Use similar bolding or section labeling without overdoing it.

- Be mindful of colors: If your resume has a subtle highlight color, mirror it in your cover letter, but just lightly, because clarity should always take priority in analytical roles.

Small visual details may feel insignificant, but in a field built on accuracy and structure, they reinforce professionalism and attention to detail.

Use these ready-to-use, optimized, and ATS-friendly templates

If formatting isn’t your favorite part or you just don't want to spend time creating yet another document, choosing a matching resume template and cover letter template can save hours and ensure consistency. They also make your application look polished without distracting from the analytical content.

When your risk manager resume and cover letter feel like they belong to the same candidate, both structurally and tonally, you make it easier for hiring managers to trust your presentation and focus on what really matters: your skills, judgment, and fit for the role.

12. Top resources for job-seeking risk managers

Risk manager resume? Check! Risk manager cover letter? Check! A job opportunity to apply for? Still pending. If you find yourself in a similar situation, perk up your ears! We've prepared a list of job resources that can help you get started:

- Industry-specific job boards: Websites with niche focus, such as Careers in Risk, eFinancialCareers, or RiskManagementWeb, are great entry points to the risk management world.

- General job search platforms: Next, you can filter through job postings offered by websites like LinkedIn, Indeed, Glassdoor, Monster, and SimplyHired.

- Consulting firms: Don't hesitate to also check out web pages of renowned risk consulting firms like Deloitte, KPMG Risk Consulting, or EY Risk Consulting Services for job vacancies and networking opportunities.

- Professional associations: Organizations like Professional Risk Managers' International Association (PRMIA), Global Association of Risk Professionals (GARP), and Risk Management Society (RIMS) offer a wealth of resources ranging from job postings and networking events to training and development.

- Specialized publications: To succeed in such a dynamic field, uts essential to keep up with media like “Risk Management Magazine,” “Risk Analysis: An International Journal,“ or “Risk&Compliance “ to stay updated on the latest news, strategies, methodologies, and industry trends.

- Continuous education: Besides professional institutions, online learning platforms, such as Coursera, Udemy, Khan Academy, or edX, also provide a wide selection of courses and certifications to choose from.

Once you've found a job opportunity that's worth the risk, don't forget to customize your risk manager cover letter to align as closely as possible with the job requirements. Because every job opening is unique and so should be each and every one of your cover letters.

Management Career Outlook in 2025

Employment in Management is expected to grow faster than the average for all occupations from 2023 to 2033. (Source: U.S. Bureau of Labor Statistics)

Every year, about 1.2 million job openings in Management are expected to open, primarily due to employment growth and the need to replace workers who leave these occupations permanently.

Among the managerial roles, Medical and Health Services Managers, Financial Managers, and Computer and Information Systems Managers are expected to see the highest growth, with projected increases of 29%, 17%, and 17%, respectively, over the decade.

Average US base salaries across popular Human Resources roles:

- Executive Manager: $78,868/year

- Product Manager: $122,634/year

- Project Manager: $90,883/year

- Risk Manager: $107,816/year

- Strategy Manager: $121,677year

Salary estimates are based on data submitted anonymously to Indeed by individuals working in these roles, as well as information from past and present job postings on the platform over the last 36 months.

These numbers may vary based on location, company size, and experience level.

All in all, if you’re currently thinking about starting a career in Management or growing within the field, now is a great time to look into the opportunities available in this industry.

Risk Manager Cover Letter FAQ

How can I use keywords effectively in my risk manager cover letter?

Sprinkle the keywords throughout your letter so they look natural, not forced. These magic words should come from the job advertisement itself, so in order to know which to include you need to review the posting first. For example: if the company says they're seeking a risk manager with “strong forecasting abilities”, use that exact phrase. This will ensure maximum compliance with ATS.

How can I showcase my skills effectively on my risk manager cover letter?

In your cover letter, nobody wants to see a long list of every skill you’ve ever learned. Instead, be selective. Pick only the core skills related directly to risk management. Show how you've used these in the past, focusing on the results your actions achieved. Add a nice touch by mentioning the skill in the context of a story or situation.

What makes my risk manager cover letter stand out from the crowd?

One way of standing out from the crowd is by avoiding clichés. Yes, 'detail-oriented' and 'good with numbers' are nice but they're also overused. Instead, paint vivid, unique pictures of your accomplishments. For example, instead of just mentioning your strong analytical skills, you could distinctly describe a situation where your analysis prevented a potential financial disaster.

How do I keep my risk manager cover letter concise and to the point?

Always stick to one single page, ideally three to four brief body paragraphs (plus introduction and closing paragraph). Start by introducing yourself, then explain why you're a fit for the role and the company, share a few key accomplishments, talk about why you want to work for this particular company, and finally wrap it up with a courteous close.

What is the best way to address a gap in employment in my risk manager cover letter?

Gaps in employment are fairly common. And you can actually turn them to your advantage instead of trying to hide it. For example: Did you do any voluntary work or freelance projects during the period? Did you complete any certifications or courses? These can demonstrate that you stayed active and continued developing your skills. If the gap was due to personal reasons, you don't have to explain in detail. A simple statement that you took time off and are now ready to get back into the workforce will suffice.