Money powers working life, yet talking about it stays behind closed doors. Everyone agrees that salaries should grow over time, but the real question is how often, how much, and under what conditions.

To understand what people really think about pay raises, Kickresume surveyed 1,850 employees from around the world.

These are just some of our most compelling findings:

- 56% of people believe raises should happen once a year, showing remarkable global consensus on what “fair” pay growth looks like.

- Gen Z leads the investing wave: 38% would invest their raise, higher than Millennials (35%) or Gen X (28%)

- 60% of Americans believe pay should increase annually, but fewer than half actually see it happen.

- Two thirds (66%) of people have tried negotiating their salary before accepting a job offer, but only half of those efforts paid off.

- Women are 10 percentage points more likely than men to be too nervous to negotiate a starting salary (28% vs. 18%).

- 26% of Americans haven’t had a raise in over two years, the highest across all regions.

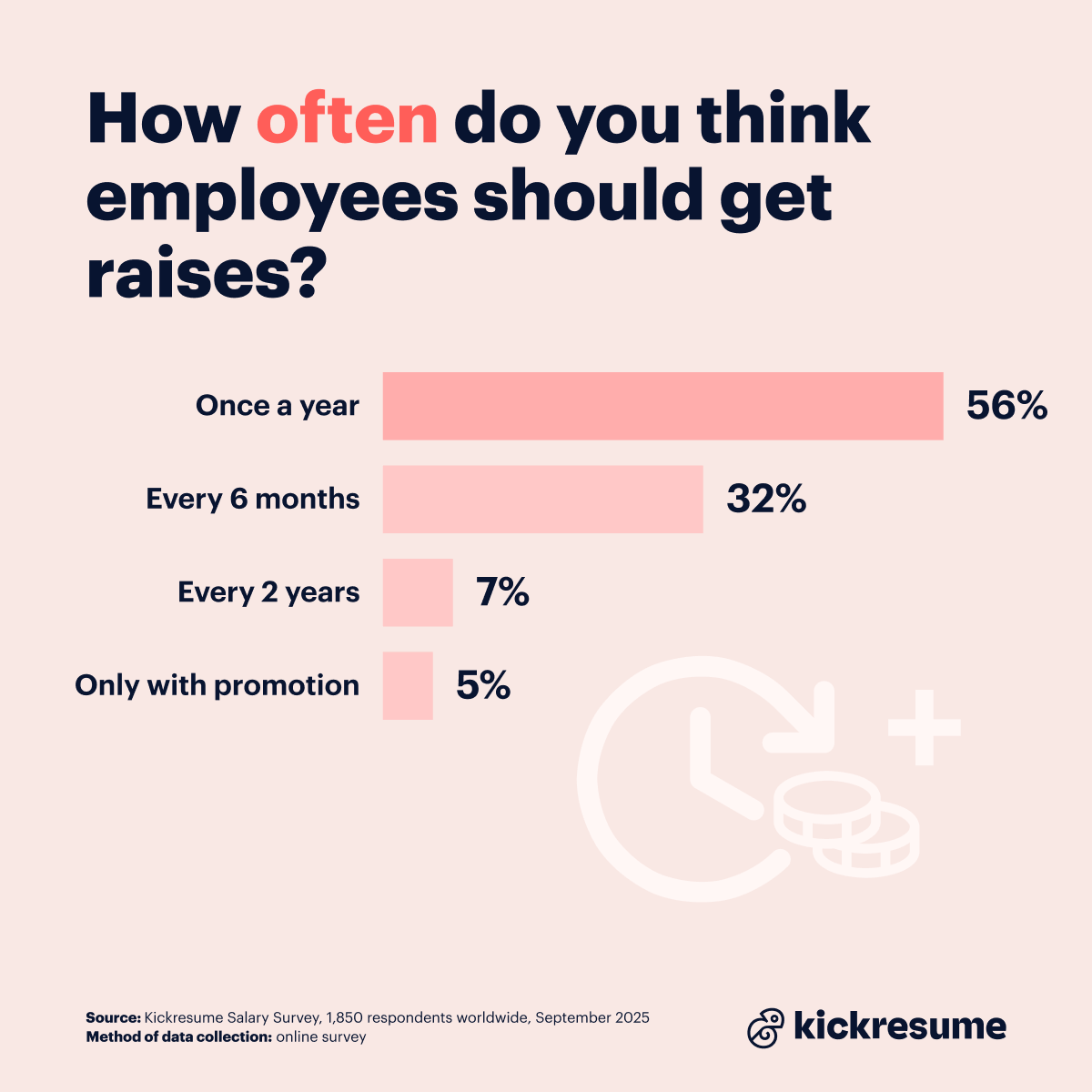

Most workers expect raises, but how often? 56% say once a year

Everyone agrees that people should get pay raises. The real debate starts when it comes to how often. For something that affects nearly every worker, opinions could easily be all over the place, but in this case, most people seem to be on the same page:

- More than half of respondents (56%) believe raises should happen once a year.

- Another third (32%) think every six months would be fair.

- Only a small group would wait longer with 7% saying every two years is enough, and 5% believe pay should increase only with a promotion.

So while people may not enjoy talking money with their boss, they do seem to agree on one thing…pay should grow regularly, not just when a new title comes along.

The gender angle: 34% of women would prefer raises every six months

Gender doesn’t seem to play a major role in how people think about pay raises. Still, there’s a small but noticeable difference in how often they think those raises should come.

- Among men, 58% say once a year is about right, while 30% think raises should happen every six months.

- Among women, 54% prefer the yearly raise, but a slightly higher 34% say every six months would be fair.

While this gap is minor, it's still there! Perhaps our female respondents have a sharper awareness of pay fairness or feel the need for a stronger push for recognition.

The generation angle: Younger workers want raises faster

The gap between those who prefer yearly raises and those who’d like them every six months widens with each generation.

- Among Gen Z, the split is almost even: 45% say once a year, while 42% want a raise every six months.

- Millennials are a little more patient: 57% say once a year, compared with 31% who prefer every six months.

- For Gen X, the gap is the widest: 68% are fine with a yearly raise, and only 23% think it should happen twice as often.

But it would be too rushed and unreasonable to attribute these differences to greediness or naivety.

Younger workers are often dealing with higher living costs, student debt, and unstable housing. Considering all of this, regular raises may feel less like a bonus and more like a necessity to keep up. Older generations, on the other hand, tend to have more financial stability and may not feel the same pressure to see their pay grow so often.

It could also reflect how quickly the economy is shifting. Younger people with less financial reserves feel the pace of inflation and the cost of living more intensely, so expecting more frequent raises might simply be a way of trying to stay afloat.

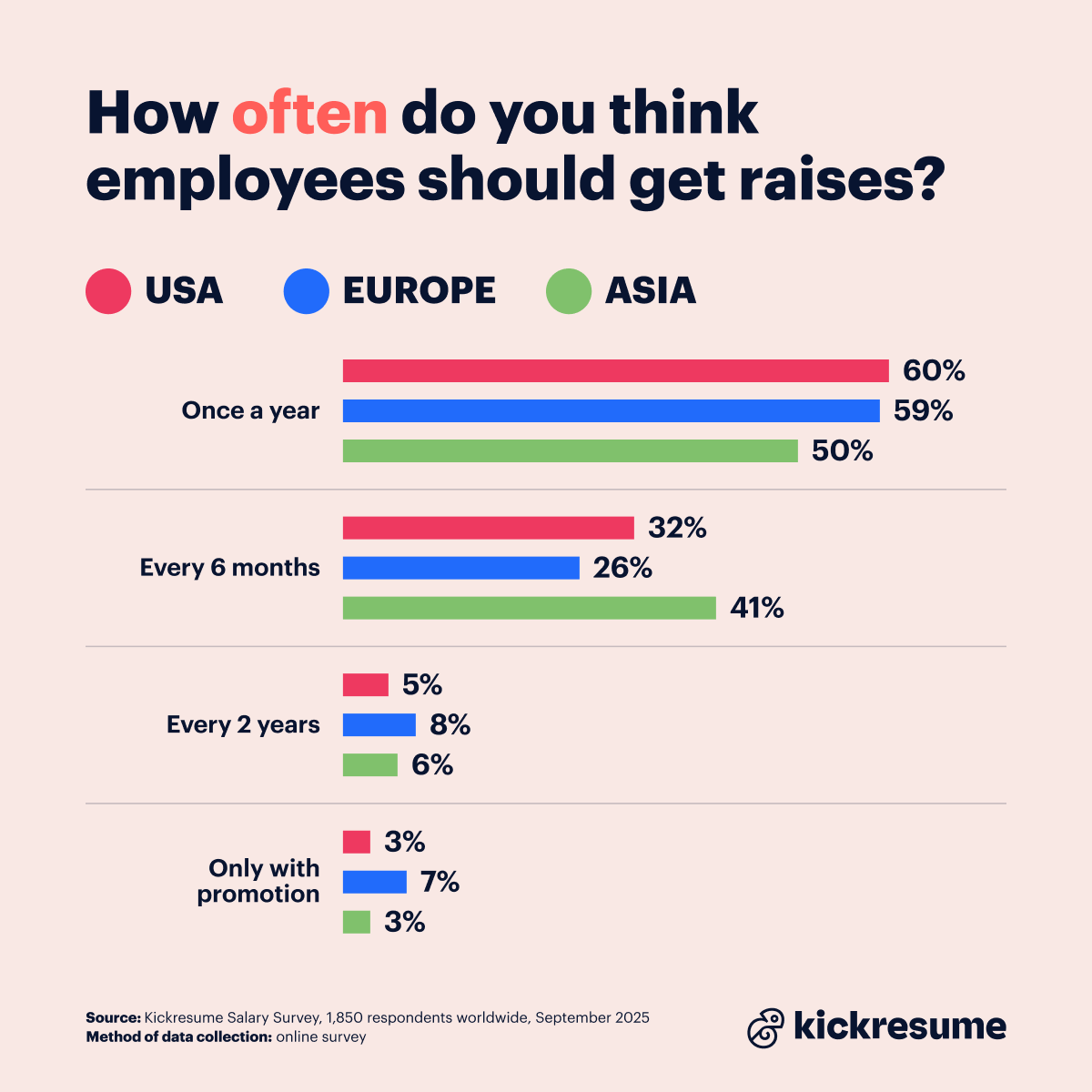

The regional angle: 41% of Asian workers push for more frequent raises

Different parts of the world have different ideas about how often raises should happen.

- In the USA, 60% of people think once a year is good enough, while 32% would prefer every six months.

- In Europe, most people also lean toward the yearly raise (59%), but fewer expect one every six months (26%).

- And in Asia, only half of respondents (50%) are happy with an annual raise, while 41% think it should come twice a year.

It seems that local work cultures and economic realities shape expectations around pay frequency just as much as personal circumstances. In fast-moving economies, where prices and opportunities shift quickly, workers may simply feel that waiting a full year for a raise no longer makes sense.

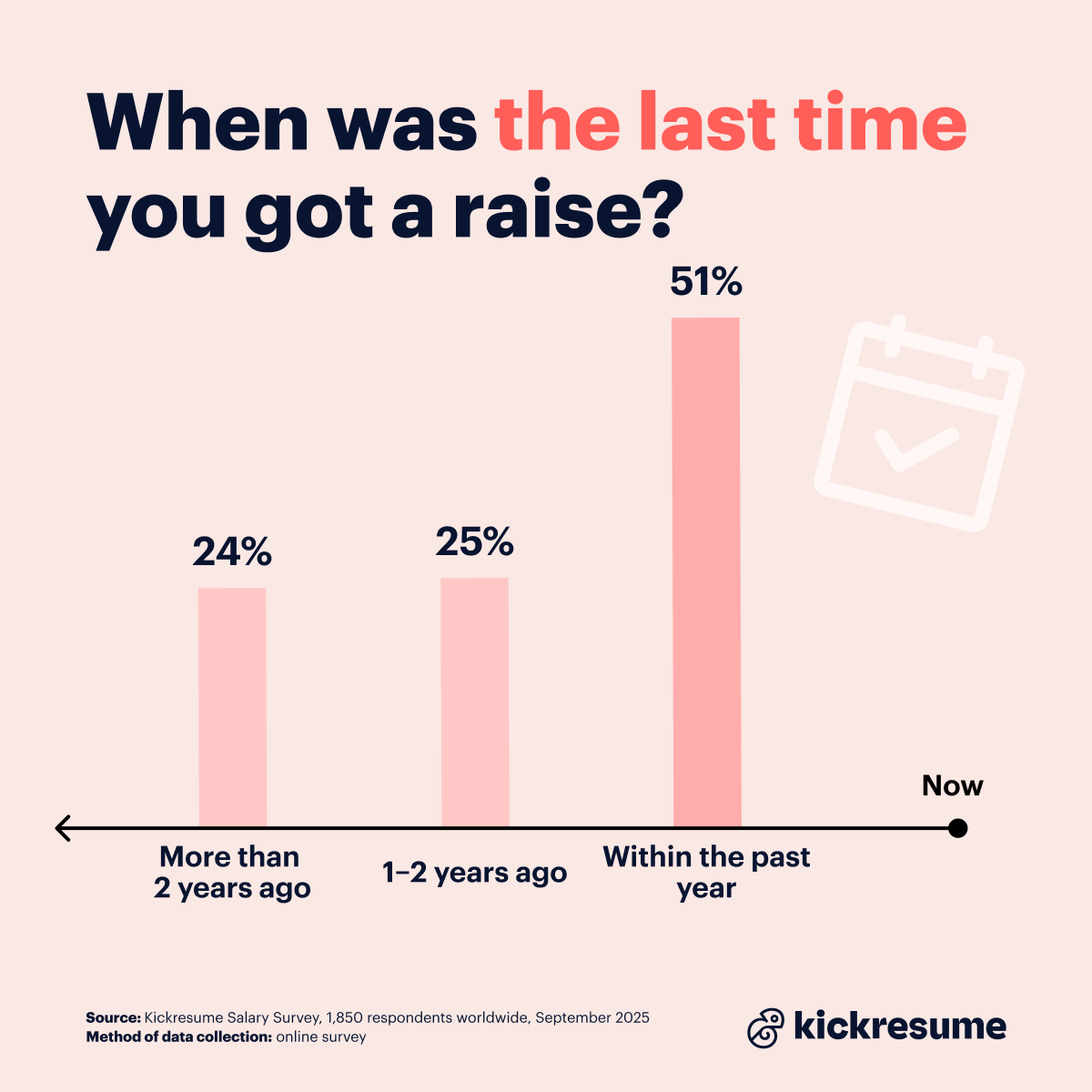

Raises happen less often than workers expect

We’ve seen that most respondents expect pay raises. But expectations are one thing and reality another. So do these expectations get fulfilled? For more than half of our respondents, they actually do!

- 51% said they received a raise within the past year.

- Another 25% said it happened one to two years ago.

- And 24% haven’t seen their pay go up in more than two years.

So while most people do see their salaries rise in line with their expectations, a significant share are still waiting for that next adjustment.

The gender angle: Men slightly ahead with 53% receiving a raise last year

Even though our female respondents think raises should happen more often (every six months) in reality, fewer women reported getting one within the past year compared to men.

- Among men, 53% said they received a raise within the past year, 23% one to two years ago, and 24% more than two years ago.

- Among women, half (50%) said they got a raise within the past year, 28% one to two years ago, and 22% more than two years ago.

So while expectations are slightly higher among women, their experience doesn’t always match.

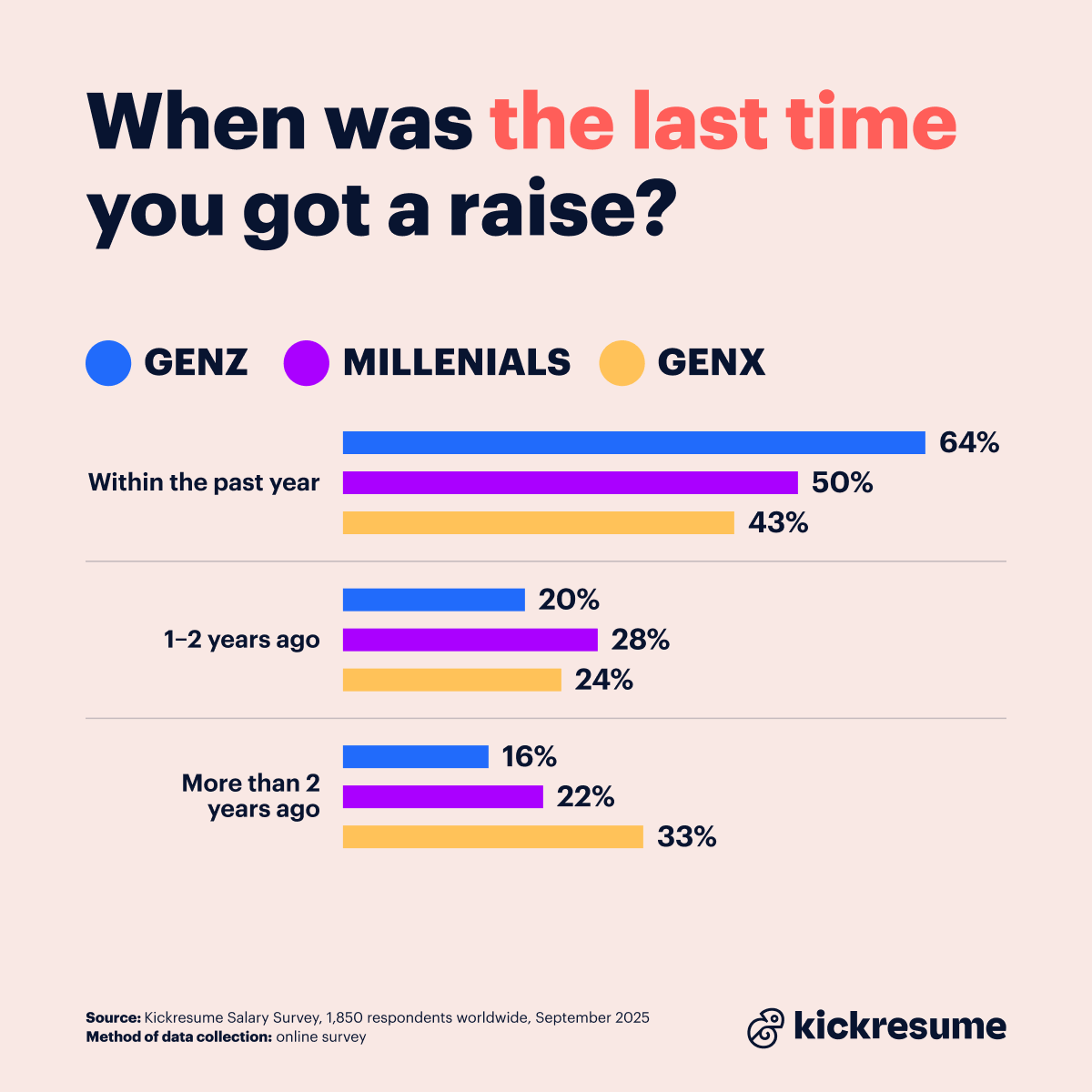

The generation angle: Big gap between expectation and reality for GenX

- Among Gen Z respondents, 64% said they received a raise within the past year, 20% one to two years ago, and 16% more than two years ago.

- Millennials were less likely to have seen a recent raise. A half (50%) got one within the past year, 28% one to two years ago, and 22% more than two years ago.

Looking at Gen Z and Millennial workers, the gap between those who received raises within the past year and those who last got one more than two years ago widens as they progress in their careers. However, it’s among Gen X that the gap stands out the most:

- Although 68% of Gen X respondents think workers should get a raise every year, only 43% have actually received one within the past year. This is the widest gap among all generations.

- Gen X are also the group with the highest share of people who haven’t seen a pay raise in more than two years (33%).

These results may reflect different stages of career progression. Younger employees are often earlier in their careers, moving between roles or companies more often, which naturally brings more frequent pay increases.

Gen X workers, on the other hand, may already be in senior or stable positions, where raises come less often. The problem is that, despite this, their expectations for regular increases still clearly remain.

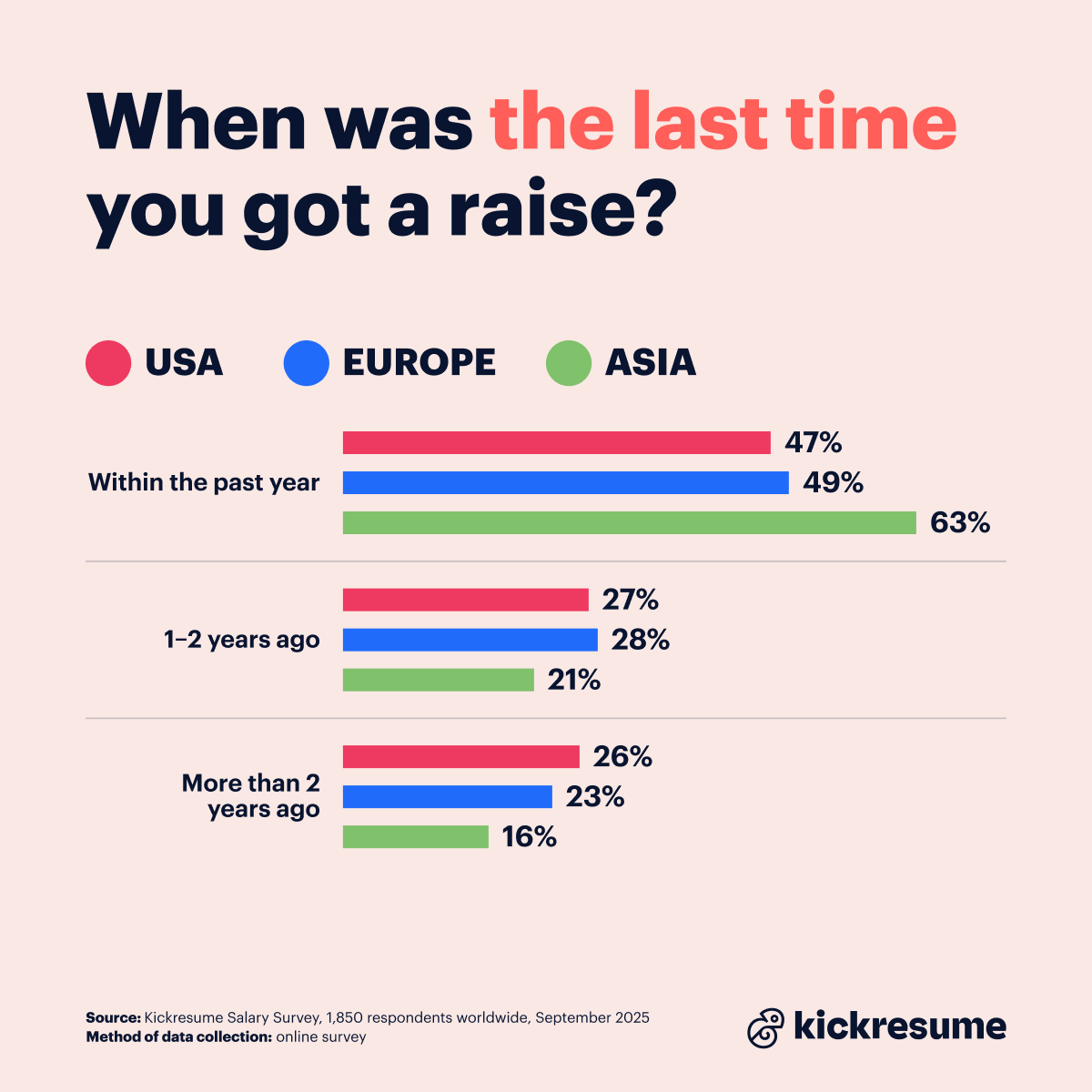

The regional angle: America ranks last in pay bumps

- In the USA, 47% of respondents said they received a raise within the past year, 27% one to two years ago, and 26% more than two years ago.

- In Europe, 49% got a raise within the past year, 28% one to two years ago, and 23% more than two years ago.

- In Asia, the numbers look more optimistic with 63% receiving a raise within the past year, 21% one to two years ago, and 16% more than two years ago.

If we look back at what people think should happen, the gap between expectations and reality is the most prominent for our American respondents.

In the USA, 60% of respondents believe raises should happen once a year, but fewer than half (47%) actually saw that happen. American respondents also represent the largest group who haven’t had a raise in more than two years (26%), compared to 23% in Europe and just 16% in Asia.

These differences may be shaped by local labor markets, economic conditions, and company practices. In Asia, where job markets are often more dynamic and competitive, pay tends to adjust more frequently. In the US and Europe, slower wage growth and longer review cycles may explain why expectations outpace reality.

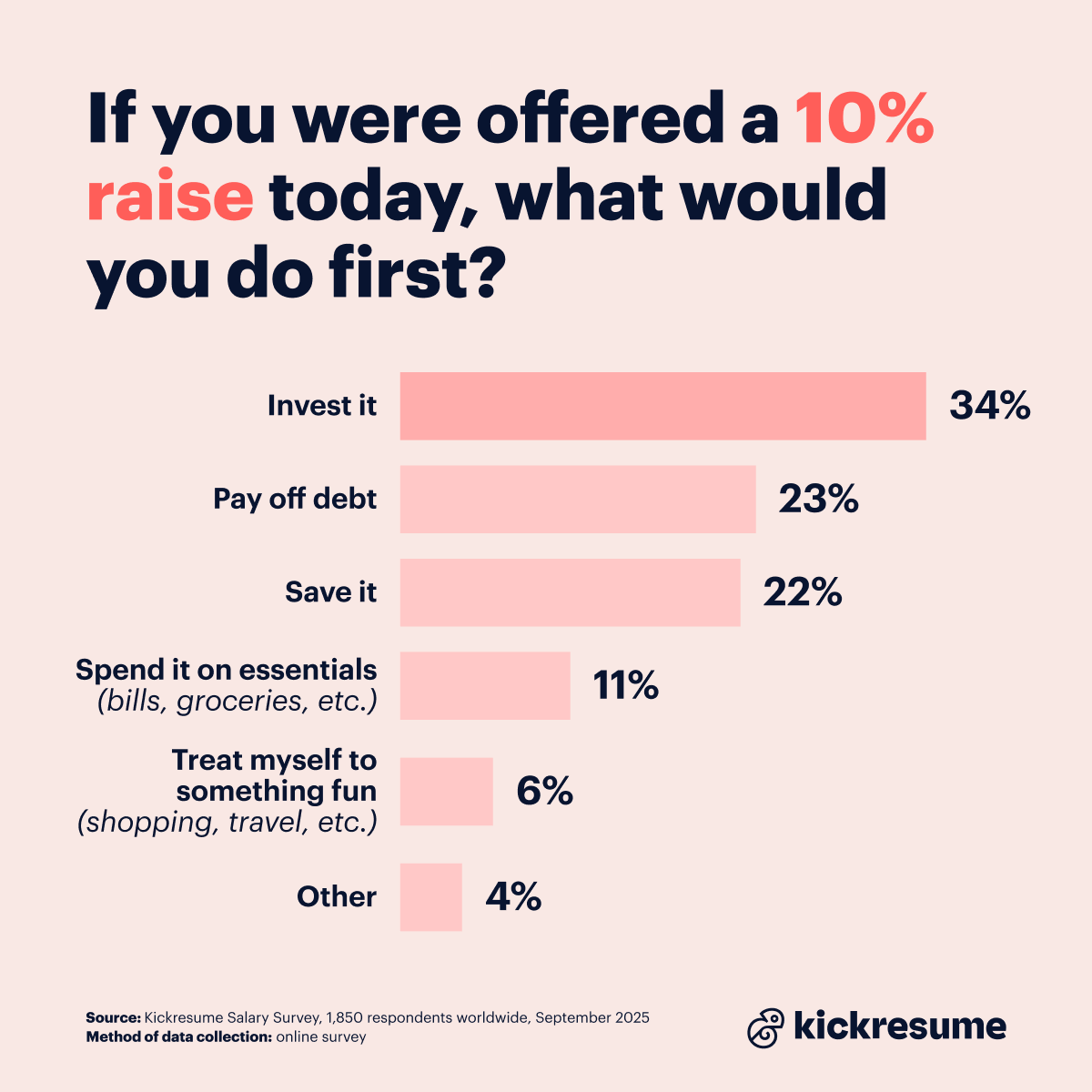

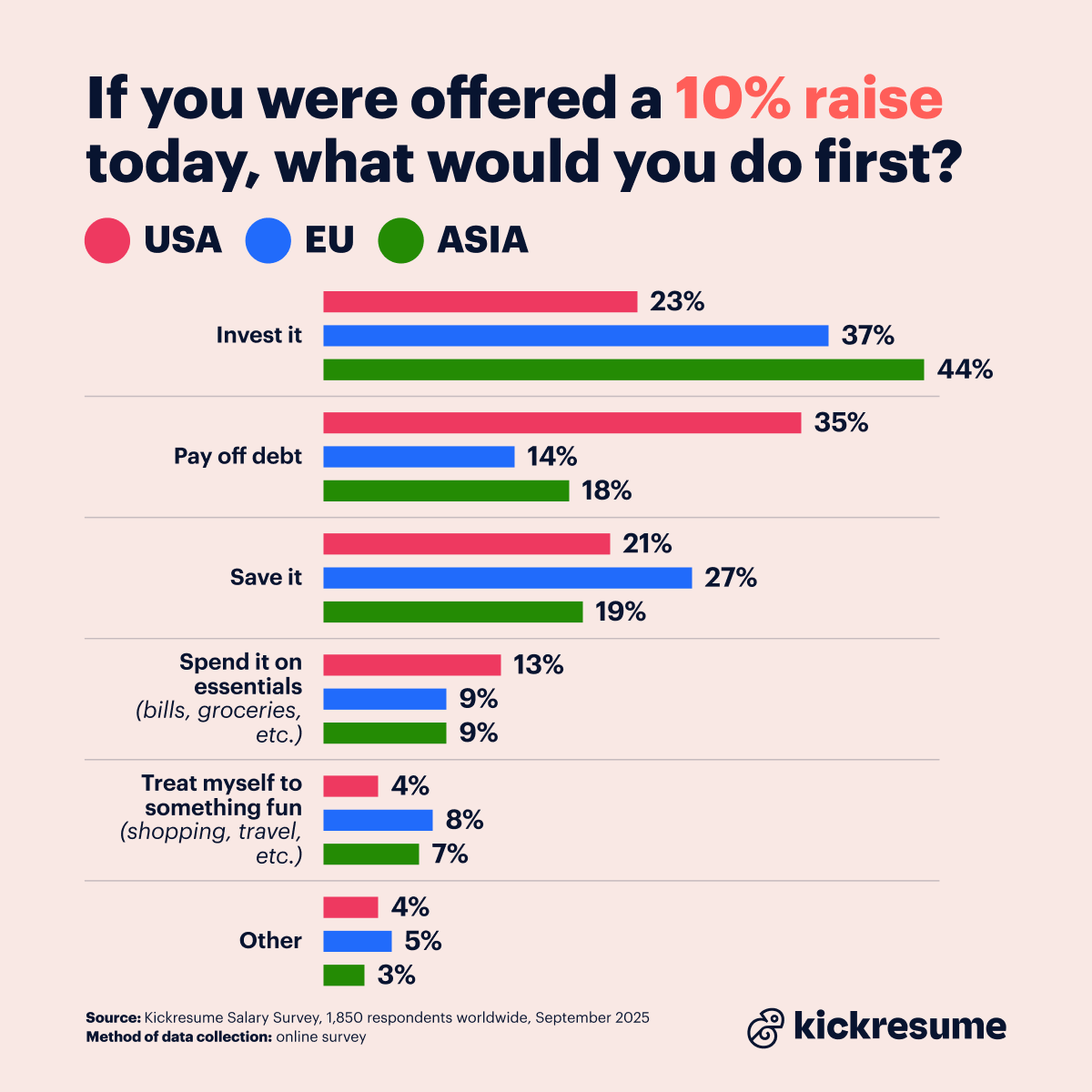

What would you do with a 10% raise? 34% would invest

So far, our survey has confirmed that most people would like to get a raise at least once a year. But what would they actually do with that extra money? What would happen if they received, say, a 10% raise today?

Here’s what our respondents told us:

- Invest it: 34%

- Pay off debt: 23%

- Save it: 22%

- Spend it on essentials (bills, groceries, etc.): 11%

- Treat myself to something fun (shopping, travel, etc.): 6%

- Other: 4%

It seems that most people would use their raise to strengthen their finances instead of splurging. The top two answers (investing and paying off debt) suggest that respondents are focused on long-term stability rather than short-term gratification.

The balance between investing and paying off debt is something we will keep a keen eye on as we analyze the results from different angles.

The gender angle: Men invest more, women save more

When it comes to a 10% raise, men and women show different approaches, especially around investing and saving:

- Men: 37% would invest it, 22% would pay off debt, 20% would save it, 11% spend on essentials, 6% treat themselves, 4% other.

- Women: 26% would invest it, 23% would pay off debt, 27% would save it, 13% spend on essentials, 7% treat themselves, 4% other.

According to our data, men are more likely to invest, while women lean more toward saving. This may reflect different attitudes toward risk taking. Men appear slightly more willing to take financial risks for potential growth, whereas women prioritize security and stability.

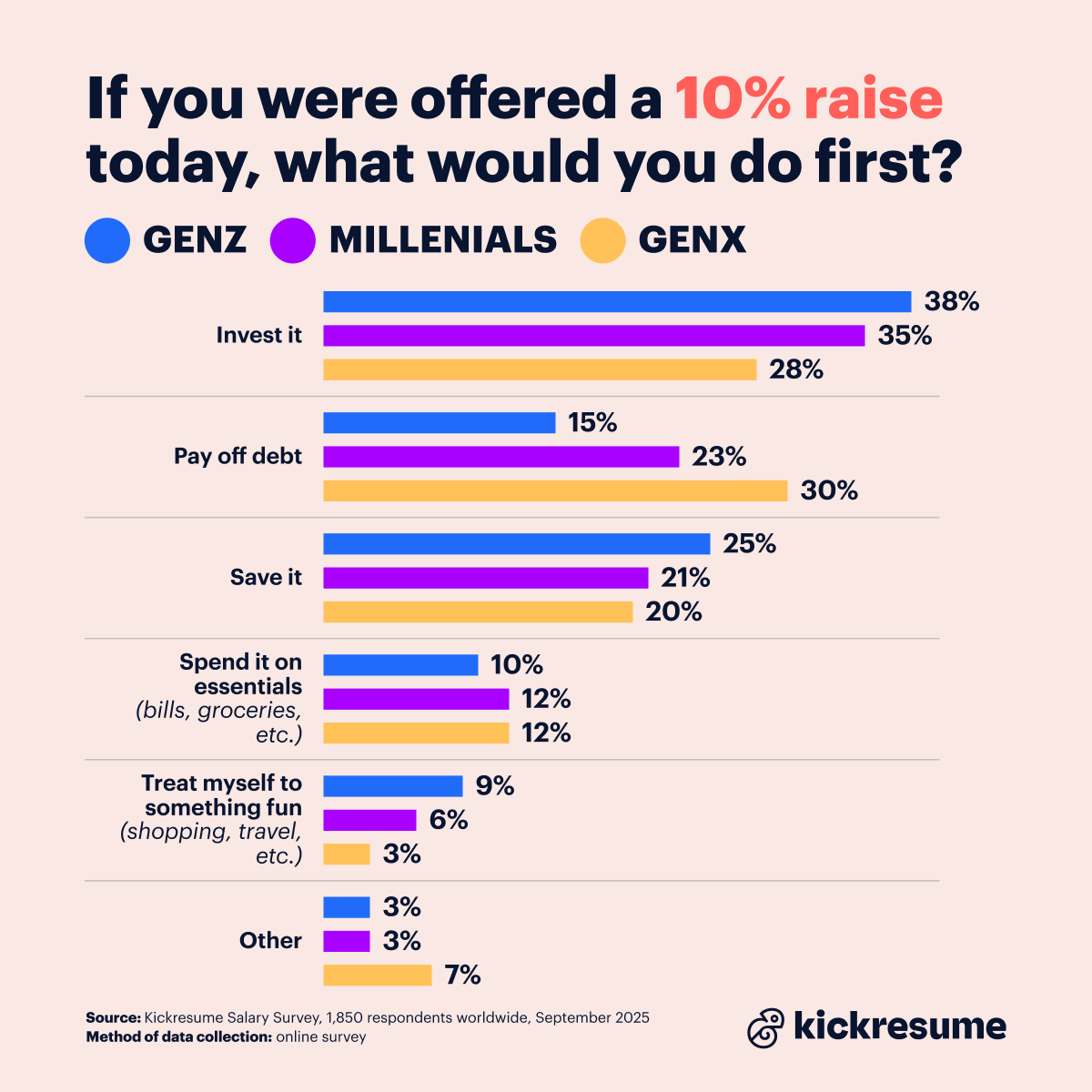

The age angle: Gen Z leads the investing trend

Younger generations are more open to investing, while older ones focus more on paying off debt.

- Gen Z: 38% would invest their raise, 15% pay off debt, 25% save it, 10% spend it on essentials, and 9% would treat themselves.

- Millennials: 35% invest, 23% pay off debt, 21% save, 12% spend on essentials, and 6% treat themselves.

- Gen X: 28% invest, 30% pay off debt, 20% save, 12% spend on essentials, and 3% treat themselves.

Investing is most popular among Gen Z, likely because it’s more accessible and familiar than it once was. Online platforms, apps, and financial content on social media have made investing part of everyday money management.

At the same time, the share of people who would use a raise to pay off debt rises with age (from 15% among Gen Z to 30% among Gen X). Older generations may be managing larger financial commitments, like mortgages or family expenses, and tend to prioritize security over risk.

The regional angle: Americans pay off debt, Asians invest, Europeans save

- In the USA, 23% of respondents said they would invest their raise, 35% would use it to pay off debt, 21% would save it, 13% would spend it on essentials, and 4% would treat themselves.

- In Europe, 37% would invest, 14% pay off debt, 27% save, 9% spend on essentials, and 8% would treat themselves.

- In Asia, 44% would invest, 18% pay off debt, 19% save, 9% spend on essentials, and 7% would treat themselves.

When we put all the answers together, we get a better idea of how financial situations differ across regions.

In the USA, the largest share of respondents (60%) believe raises should happen every year. Yet only 47% actually received one within the past year, which is the smallest percentage across all regions. And if Americans were to get that long-awaited 10% raise, they would be the most likely to use it to pay off debt rather than invest or save.

It's also worth pointing out that a higher percentage of Americans would spend their extra cash on essentials like bills and groceries (13%) compared to Europeans and Asians (both 9%). At the same time, Americans are the least likely to spend it on something fun (only 4% said they would treat themselves, compared to 8% of Europeans and 7% of Asians).

These differences likely reflect broader economic realities. Higher living costs, widespread debt, and limited financial security in the US seem to leave less room for saving or investing. In Europe and Asia, where social safety nets are stronger or household debt tends to be lower, people may have more freedom to invest or use their extra income for enjoyment.

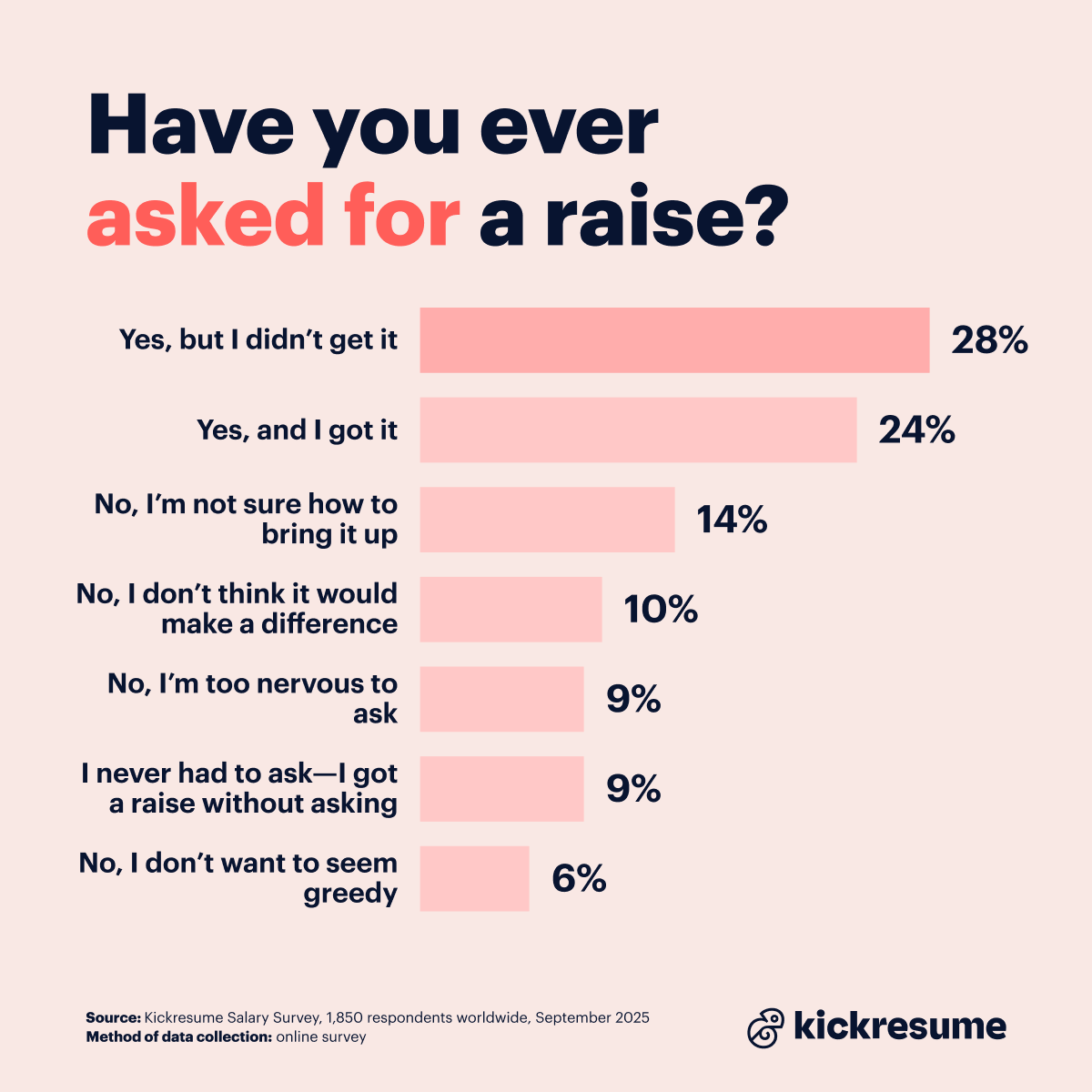

52% ask for a raise, only 24% actually get one

It would be nice if yearly raises were the norm, but just like with anything in life, closed mouths don’t get fed. 52% of our respondents understand that very well, although their efforts might not have uniform results.

In total, just over half of respondents have asked for a raise at some point: 28% said they asked but didn’t get it, while 24% said their request was successful.

The rest have never brought the topic up:

- 14% admit they’re not sure how to start the conversation, 10% don’t think it would make any difference, and 9% are simply too nervous to ask.

- Another 9% said they never had to ask because they received a raise without bringing it up, and 6% said they avoid the topic altogether because they don’t want to seem greedy.

So far, all our questions have revealed clear differences among respondents of different ages, regions, and genders. But when it comes to actually asking for a raise, those differences almost disappear.

- Men appear slightly more assertive when it comes to asking for a raise. 54% have done so (29% didn’t get it, 25% did), compared to 48% of women (26% didn’t get it, 22% did).

- Among generations, Gen Z respondents are the least likely to have received a raise after asking (only 18%) and the most likely to admit they don’t know how to bring it up (18%) or that they’re too nervous (12%).

- European respondents were the most successful in getting a raise after asking (30% said yes, the highest across all regions).

- Americans, on the other hand, seem somewhat discouraged: while 26% did get a raise, 15% said they don’t think asking would make a difference, the highest proportion among all groups.

Whether shaped by social norms, workplace dynamics, or personal comfort levels, the willingness to start that conversation often determines who sees their paycheck grow and who stays waiting.

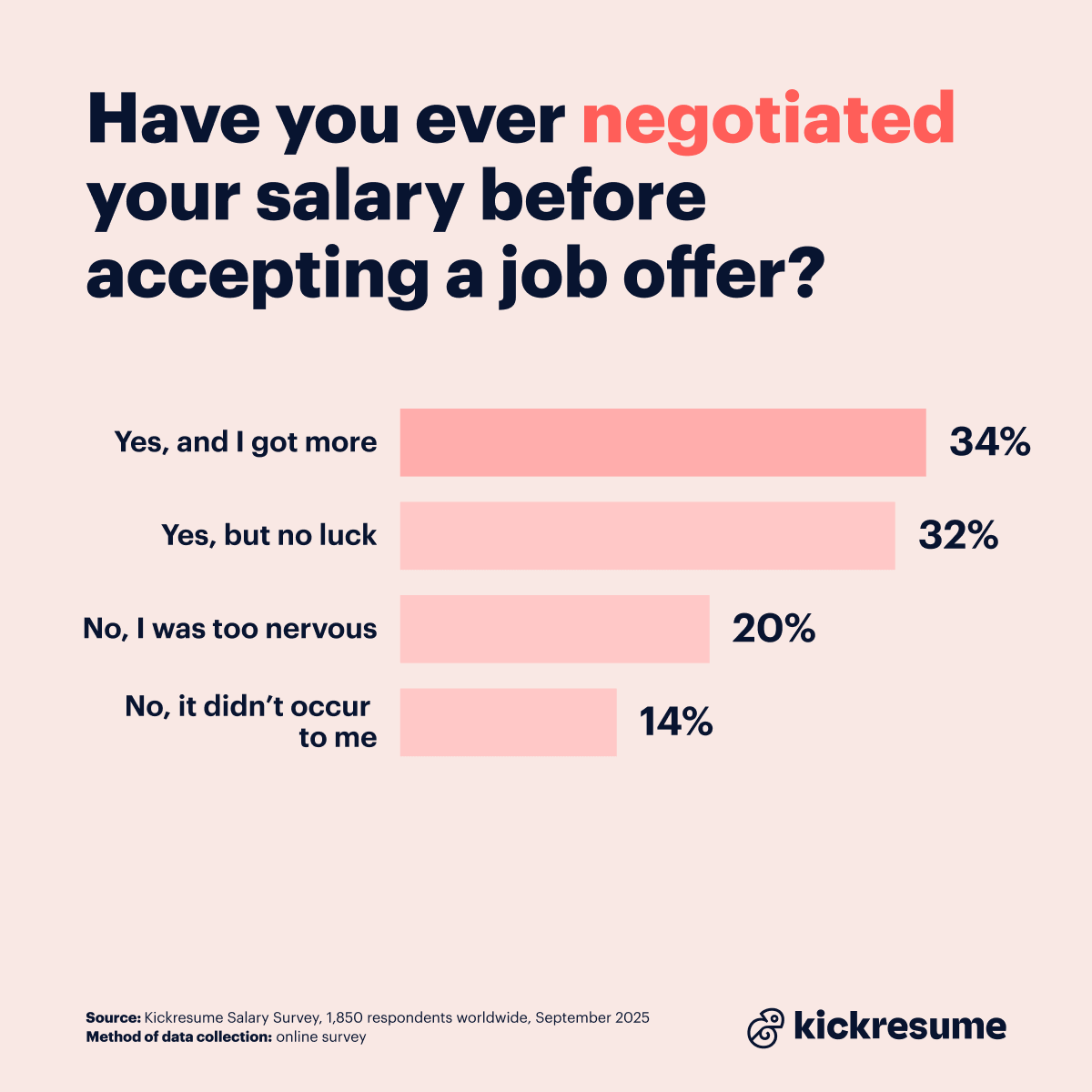

Two thirds of workers negotiate salary before signing the offer

For many people, switching roles or companies is the best opportunity to finally earn what they feel they deserve. Job hopping has become its own kind of raise, but only if you’re willing to speak up when the offer lands on the table.

The good news is that most people are. Two thirds of our respondents (66%) said they tried to negotiate their salary before accepting a job offer. However, it worked for only half of them:

- While 34% managed to secure a higher starting pay, another 32% said their efforts didn’t pay off.

- Meanwhile, nervousness held back 20% from even trying, and 14% admitted the idea simply didn’t occur to them.

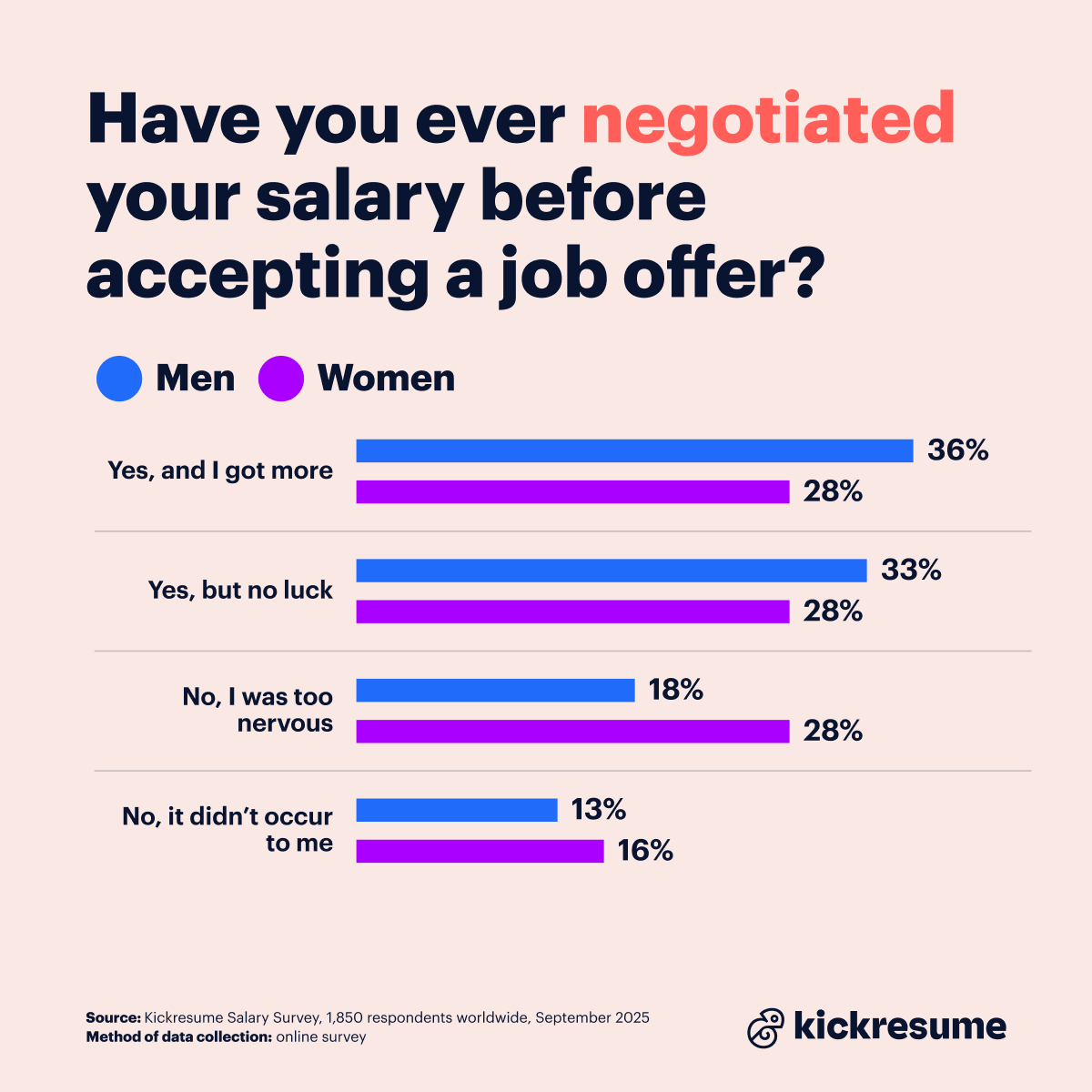

The gender angle: Women face more nerves at the negotiating table

Men seem slightly more confident at the negotiation table.

- Over two thirds have tried to negotiate their starting salary, with 36% succeeding and another 33% giving it a shot but without success.

- Only 18% said they were too nervous to ask, and 13% admitted it simply didn’t occur to them.

Women, on the other hand, appear to face a tougher psychological barrier.

- While 28% successfully negotiated a higher salary and another 28% tried but didn’t get it, a striking 28% said they were too nervous to negotiate at all, which is ten percentage points more than men.

- Another 16% didn’t even consider asking.

Overall, nervousness stands out as the key difference here. Women seem to hesitate more when it comes to asking for more, even before the job begins, while men appear more comfortable testing their luck.

The generation angle: Confidence to negotiate grows with age

Overall, Gen Z workers seem to find salary negotiations the hardest:

- Only 20% managed to secure a higher offer, while 30% tried but didn’t succeed.

- Another 30% said they were too nervous to negotiate at all, which is the highest share among all age groups.

- For 20%, the idea of asking for more money didn’t even cross their mind.

In comparison, Millennials show more confidence:

- Over two thirds have negotiated their salary, with 36% succeeding and 34% trying but falling short.

- Nervousness affected 18%, already a noticeable drop compared to Gen Z, and just 12% said the thought never occurred to them.

And finally, Gen X respondents were the most successful negotiators of all:

- Nearly half (43%) said they got more money after negotiating, while another 30% tried but didn’t get it.

- Only 15% felt too nervous to ask.

Our data shows that confidence clearly grows with age. In this context, Gen X likely benefits from experience. They’ve built a proven track record, developed in-demand skills, and often know their market value better than younger colleagues.

The regional angle: Pay talk success seems to depend on where you work

Our USA respondents were the most successful negotiators overall:

- 41% said they managed to secure a higher salary, while another 27% tried but didn’t get it.

- One in five (20%) admitted they were too nervous to ask, and 12% said it never occurred to them.

- Europeans followed closely behind, with 39% successfully negotiating better pay and 27% trying without luck.

- Nervousness held back 21% of Europeans, slightly higher than in the U.S., and 13% didn’t think to ask.

- Only 31% of our Asian respondents reported success, while 38% said their attempts didn’t pay off (the highest “no luck” rate among all regions).

- 17% were too nervous to negotiate, and 14% said it didn’t cross their mind.

According to these results, Americans appear to have the most success turning negotiations into results, while Asian workers may face more barriers or tougher employer responses. Cultural norms and differing workplace expectations could play a big role in how comfortable people feel asking for more, and how often that “ask” actually works.

Final thoughts

Money talks at work are never easy, but they shape how people feel about their jobs. Most employees expect raises at least once a year, yet many haven’t had one in over two years. Nervousness, timing, and workplace culture often get in the way.

When people do get extra pay, most think carefully about how to use it. Many choose to invest or pay off debt rather than splurge, showing that raises are more about security and planning than short-term treats. Experience helps too, older workers tend to negotiate more successfully, while younger employees, women, and certain regions still face bigger challenges.

Ultimately, raises and salary talks shape how supported and confident people feel at work. Understanding this can help companies create fairer systems and encourage employees to speak up.

Demographics

Gender

- Male: 70%

- Female: 29%

- Non-binary or other: 1%

Age

- Under 18: <1%

- 18–28: 27%

- 29–43: 46%

- 45–60: 24%

- 61–79: 2%

- 79 or older: <1%

Location

- Africa: 10%

- Asia: 22%

- Australia/Oceania: >2%

- Europe: 25%

- Latin America: 10%

- North America: 30% (88% based in the USA)

Note

This anonymous online survey by Kickresume, conducted in September 2025, gathered insights from 1,850 respondents globally. All participants were reached via Kickresume's internal database.

About Kickresume

Kickresume is an AI-based career tool that helps candidates source jobs and raise salary with powerful resume and cover letter tools, skills analytics, and automated job search assistance. It has already helped more than 8 million job seekers worldwide.