Why is pay talk still so hard—and what would it take to break the silence, close gaps, and make work fairer for everyone? Despite new pay transparency laws sweeping the globe, nearly half of employees have never talked about their salary with a coworker.

To understand what’s holding these conversations back—and how we might move forward—we spoke to Kat Aiken, human resources specialist and career coach. The expert explained that while talking about money at work can feel uncomfortable for many, not having these conversations keeps pay inequality hidden, and could hold you back from getting a raise.

Here are the main highlights:

- Keeping quiet about pay hides wage gaps—open conversations can bring change.

- We’re most likely to discuss salaries with coworkers who share our age or gender.

- Pay transparency laws in the US and EU protect the right to talk about salary.

- Companies that check wages and raise pay fairly have happier teams.

- Around the globe, organizations are championing fair pay and offering support.

Money talk at work feels inappropriate to many

Despite its impact on our lives, money remains a sensitive—and often taboo—topic at work. Many people find it difficult to discuss, as it’s long been considered inappropriate or even rude.

Some people find talking about money harder than others—our recent survey into salary talk suggested that younger people and men feel more comfortable than older people and women. As HR expert Kat Aiken explains, it often depends on who you’re talking to—people might feel more at ease talking about this subject with colleagues they feel they have more in common with.

Coworkers of a similar age are more likely to talk about money

The HR specialist confirmed what we found in our recent survey: younger employees—like Millennials and especially Gen Z—are more likely to talk about money, while “Baby Boomers and Gen X are quieter about finances.”

The career coach added that employees usually talk to colleagues close to their own age, since they tend to have shared experiences and face similar situations. For instance, colleagues who are both old enough to have grown up children might talk about the financial pressures that sending a child off to college can bring.

We’re also more likely to talk about pay with colleagues of the same gender

Mirroring generational trends, Kat noticed that women are more likely to discuss financial topics with other women, while men are more likely to talk about their salary with other men.

These patterns go beyond just who people talk to—they also reflect deeper differences in how men and women relate to money. For example, a 2024 survey found that men are more likely to use positive words like “disciplined” and “strategic” to describe their relationship with finances, while women more often use words such as “exhausting” and “stressful.”

These differences in how men and women relate to money may shape not only how openly they talk about finances, but also what topics they choose to discuss.

It’s clear to see that awkwardness around money talk isn’t just personal. It’s also a wider generational and cultural issue, with lots of people who’d like to be more open feeling unable to, because they’re worried it’s not acceptable.

Top salary talk killers in the workplace

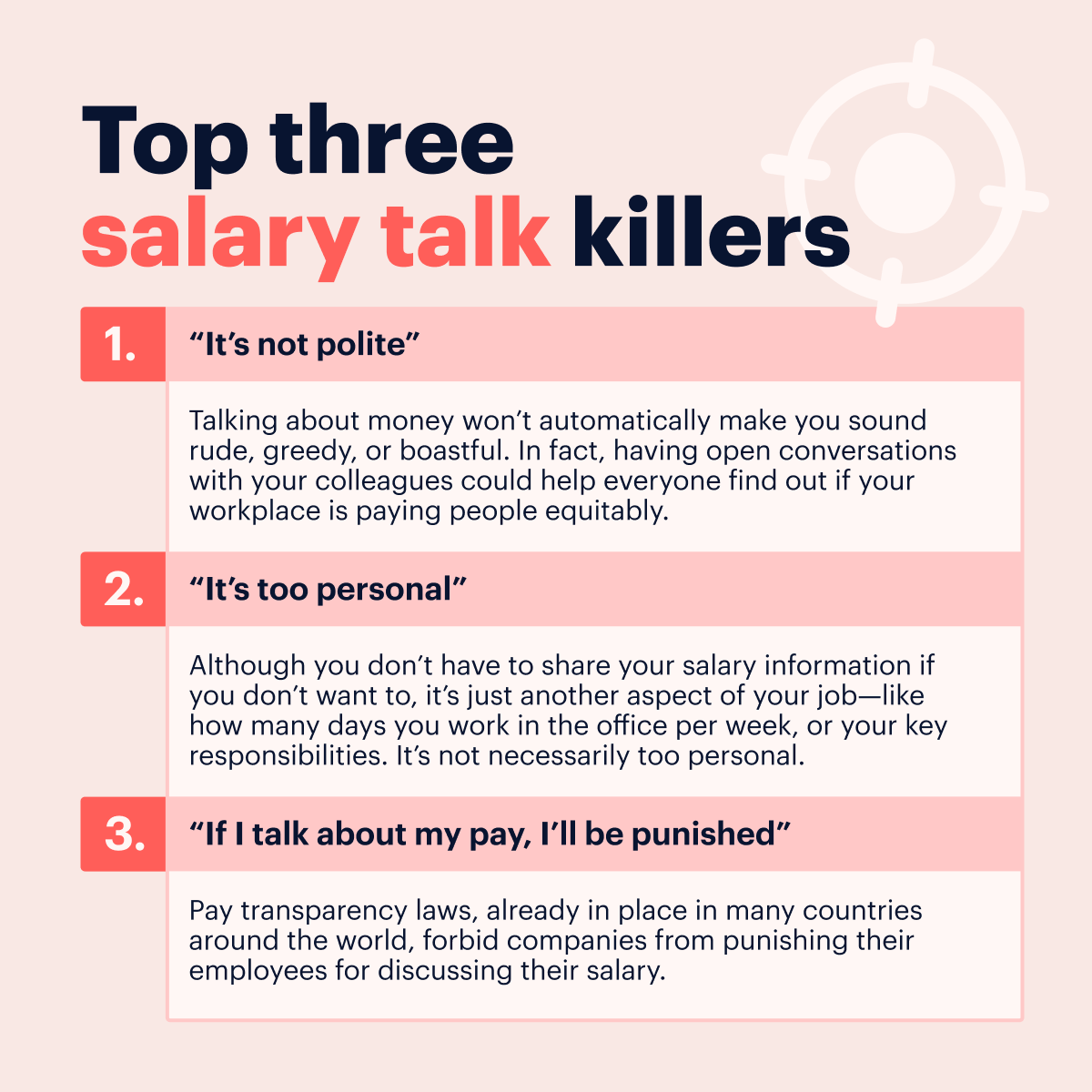

Talking about finances at work has long been a taboo, with fears like “If I talk about my pay I’ll be punished” keeping people silent. (As we’ll go on to discuss, pay transparency laws around the world actually protect workers from this!)

While some people still believe talking about money isn’t polite or that it’s too personal, workplace culture is changing, with 40% of Gen Z workers sharing in our recent survey that salary is openly discussed at their organizations. Let’s bust some more myths that keep workers from discussing their pay.

Discussing your salary is (or will soon be) a legal right in many countries

Some people in our recent survey reported not being allowed to talk about their salaries with their coworkers (although some do anyway)! But there are actually laws around the world that protect your right to do this, both already in place and soon to be introduced.

Pay transparency laws entitle employees to a range of rights, which many people aren’t aware of, leaving them feeling too nervous to talk about money at work. These laws create opportunities for frank conversations about salaries—as long as people are aware of them.

Kat Aiken explained that in the US, the National Labor Relations Act means that employers can’t forbid their staff from discussing their salaries. Some states and cities have local laws that go further—requiring companies to share salary ranges or minimum salaries for job postings, or banning inquiries into candidates’ salary history. Some of these laws have been introduced as recently as this year, welcoming a new chapter for pay transparency in the US.

And in Europe, by 2026, the EU Pay Transparency Directive will require member countries to implement new rules. Employees will be able to request peer salary information, and job seekers will receive salary ranges upfront. Organizations with over 100 employees must report any gender pay gaps, and take action to address gaps greater than 5%.

The fact that new laws are being introduced is a great sign. Legal frameworks are encouraging companies to be open with their staff about salaries and make sure they’re addressing pay gaps. But while laws can make transparency possible, true comfort with these conversations depends on building a supportive workplace culture.

Companies should encourage employees to talk money

Secrecy around pay can contribute to an unhealthy company culture—greater pay transparency could help rebuild that trust. There are lots of ways that companies can work to make openness and financial wellbeing part of their culture, as well as following the steps laid out in pay transparency laws.

Even if talking about salary feels too personal, employees are often more comfortable discussing topics like retirement savings. And that’s a great starting point! From there, companies can go further by ensuring pay is fair and transparent. And to keep the momentum going, training and financial education can give employees real confidence about money.

Retirement planning: easier to talk about than salary for some workers

Kat Aiken observed that employees are often more comfortable discussing retirement savings, meaning this topic could serve as an entry point to financial openness at work. The HR specialist points out that conversations around 401(k) or pension contributions are common, in part because people can talk in percentages rather than actual numbers.

“If the company provides a 4% match in their 401K program, most people don't have a problem speaking about that and saying that they use the 4% to its full advantage,” Kat told us. It’s a way to talk about money without crossing personal boundaries, and it gets people thinking about their financial futures.

Planning for retirement can be stressful. Even though HR can't give financial advice, there’s an appetite for more help and information with things like 401(k)s—Kat shared that in the course of her career, employees have approached the HR department asking about this topic.

Raises: little and often, not a big one once in a blue moon

How can companies create the kind of working environment where employees have conversations about money that don’t end in disappointment? Ultimately, for pay conversations to feel healthy, companies need to make sure they’re paying people fairly. Only 28% of respondents in our recent salary satisfaction survey described themselves as content.

Kat Aiken told us, “Most of the time, employees simply want to be heard and their concerns to be taken seriously. So, checking and following up on their pay and adjusting it if needed is the most effective strategy. The three main categories to investigate and ensure their pay is fair are market value, tenure, and experience/education.”

The expert also advised that companies should do regular wage surveys to make sure that everyone’s being paid fairly compared to the market. Kat shared that a proactive approach to raises might help, suggesting it’s “a better strategy to give small, reliable bonuses and raises. To most employees, awarding a 2% raise or a 4% bonus every year is better than a 10% raise in year 5.”

If you haven’t received a pay bump in a while and feel you’re due one, it’s normal for approaching your boss for a raise to feel a bit nerve-wracking. However, the company culture shouldn’t make you feel like you’re not allowed to start the conversation.

Companies can use external training to empower their employees

People who feel like their employers are looking out for all aspects of their wellbeing—including their financial wellbeing—might be happier at the company and more likely to stay long-term. Kat Aiken suggested a few ways that companies can help their workers get more confident managing money and build their financial literacy.

- Automatically enrolling workers in a 401(k) or pension plan—while they have the option to withdraw, this “forces awareness of the program and lets employees think about their future”.

- Giving employees access to a financial advisor, whether occasionally or as a permanent perk.

- Courses and training led by external financial experts on topics such as retirement planning.

With the current high cost of living, many people are thinking about how to make their money work harder these days. So, employees might really value some help and advice from financial experts linked to their company. Training and workshops can make employees feel more informed and empowered, providing them with a real benefit to working at the organization.

Break the silence: an action plan for pay transparency

So whether you’re an individual employee or a manager, what can you do to champion pay transparency and fairer pay within your organization?

For individual employees:

If you decide to approach your boss for a raise, maybe after finding out that you’re being paid less than your colleagues, there are lots of useful tips in our recent conversation with an expert on workplace negotiation.

- Research industry wages. Start by gathering information on typical salaries for your role within your industry. If you discover that your pay is below average, you'll be in a stronger position to negotiate a raise.

- Assess your contributions. Make a detailed list of your achievements, strengths, and the ways you’ve added value to your team or organization. These examples will help you justify your request for higher pay.

- Practice your talking points. Rehearse how you'll present your case, ideally with a friend, mentor, or even in front of a mirror. Preparing in advance can make the conversation feel less intimidating.

- Schedule a meeting with your manager. Once you feel ready, reach out to your manager to arrange a time to discuss your salary—in person if possible, as face-to-face meetings often yield better outcomes.

But making sure employees are paid fairly shouldn’t just be on their shoulders.

For managers:

- Do some competitor analysis. Find out what other companies in your field are paying their employees for equivalent jobs at your organization.

- Organize a pay review survey. The survey should be anonymous to make sure that people feel safe saying they’re unhappy with their pay.

- Collaborate with the finance department. Make sure you know what’s feasible for the company in terms of raises. You don’t want to make any promises you can’t follow through on.

- Encourage anyone asking for a raise to share their reasoning. If you have to go to your own manager to justify giving your direct report a salary bump, it’ll really help if you have all the information.

- Plan regular performance reviews. These conversations are vital for checking in on your employees and making sure they’re satisfied. They’re also an ideal time to discuss salaries, and you might find that this is when your team brings up the issue of a raise.

Before you ask: Know your rights (and where to find them)

There are many global organizations dedicated to researching and promoting fair pay. Here are just a few examples:

- Equal Pay Today: Equal Pay Today is a project organized by the American non-profit Equal Rights Advocates. This organization works to close gender and racial pay gaps, and provides information and resources on pay gaps in the US.

- European Pay Transparency Directive: The official page for the new European Pay Transparency Directive on the European Council website explains the new rules as well as the problems they aim to solve.

- SHRM: SHRM or the Society for Human Resource Management, established in 1948, researches and advocates for equitable workplaces.

- Glassdoor: A free tool, Glassdoor allows members to look up real salaries at different companies, making it easier for people to understand whether they’re being paid in line with industry standards.

Final thoughts

With new laws granting us the right to talk openly about pay, employees and leaders alike have a unique opportunity: to break the old money taboos for good. Speaking up about salary isn’t just about numbers on a payslip—it’s about building trust, boosting confidence, and closing gaps that have lingered in the shadows for too long.

Still, real change takes more than new regulations. It comes to life when each of us—no matter our role—chooses to have honest conversations and champions fairness at work. Start small if you need to: ask questions, share information, and encourage openness with your teams or peers. When we normalize these discussions, we empower ourselves and protect each other’s interests.

Note

Kickresume spoke to HR specialist and career coach Kat Aiken in October 2025. She shared insights into the kinds of conversations people have about money at work and provided an overview of pay transparency laws. Kat Aiken also offered tips on how businesses can help their employees feel more comfortable and confident discussing money in the workplace.

About Kickresume

Kickresume is an AI-based career tool that helps candidates source jobs and raise salary with powerful resume and cover letter tools, skills analytics, and automated job search assistance. It has already helped more than 8 million job seekers worldwide.