Looking to crunch more than just numbers in the tax world? The secret is a killer tax services cover letter. It's more than just balancing accounts — it's your chance to show off your commitment to detail and your flair for finance.

Our handy tips, real-life examples, and easy-to-use templates are here to help you build a cover letter that really sells your strengths.

Keep reading to learn all about:

- Exploring handy tax services cover letter samples

- Formatting your tax services cover letter the right way

- Creating a tax services cover letter header & headline

- Crafting a personalized greeting on your tax services cover letter

- Writing a memorable tax services cover letter introduction

- Showcasing your value & accomplishments as a tax services professional

- Ending your tax services cover letter with a strong closing statement

- Avoiding common mistakes in your tax services cover letter

- Pairing your cover letter and resume

- Understanding the average salary and job outlook for tax services professionals

- Accessing the best job search resources for tax services professionals

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

Audit/tax intern cover letter sample

What are the strengths of this intern cover letter sample?

- Enthusiasm for company: The candidate shows a strong enthusiasm for CohnReznick — mentioned their awareness of the company's reputation, having known them since high school, and eagerness to work there. Employers value candidates who are genuinely excited to join their organization.

- Relevant skills & achievements: The applicant refers to academic accomplishments and involvement in relevant associations. They talk about their major, minor, memberships, and case competition victories. These details display commitment and qualifications in the field.

So what are the areas for improvement?

- Length and readability: The letter is quite lengthy with dense paragraphs. This could intimidate a busy hiring manager. Keeping paragraphs short (2-3 sentences) would make it more reader-friendly.

- Repeating information: The writer has reiterated their excitement for the role and the company in every paragraph. This repetition could be replaced with more valuable information (i.e., examples of past work, transferable skills).

- Lack of clear value in the opening paragraph: The letter indeed lacks a clear value proposition upfront. Instead of starting with generic statements, it's more effective to start with a strong, clear proposition of what the applicant brings to the table.

Tax specialist cover letter example

Why does this tax specialist cover letter work?

- Professional experience: Arnold does well in showcasing his extensive industry experience, possessing more than five years in the field. This tenure underpins his suitability for the role.

- Relevant accomplishments: The applicant shines a spotlight on his accomplishments. He mentions staying updated with current laws, implementing new procedures to decrease unnecessary expenses, and managing staff.

- Educational background and software proficiency: He successfully highlights his relevant degree and knowledge of required software programs, further establishing his competence for the role.

What could make this cover letter even better?

- Quantifiable achievements should be mentioned: While Arnold mentions several accomplishments, he fails to provide any numbers to support them. Quantifying achievements lends credibility and gives a clearer perspective of the scope of his accomplishments. For instance, by what percentage has he managed to decrease unnecessary expenses? Answering such quantifiable queries can greatly enhance the impact of his cover letter.

- Better closing statement needed: The closing doesn't leave a strong final impression. While it's important to thank the employer for considering the application, adding a proactive line could improve the ending. Arnold could mention that he's excited about the opportunity to further discuss his experiences and how they could benefit the company.

Tax manager cover letter sample

Why does this tax manager cover letter sample work?

- Use of action words: The candidate uses numerous action words in his letter. Phrases like "coordinated," "managed," "implemented," and "analysed" paint a picture of a proactive professional who takes initiative in his role.

- Specific achievements: Noah lists clear, specific achievements during his tenure at PWC, Inc. This provides a tangible measure of his capabilities and the value he could potentially bring to the hiring organization.

- Mention of awards and recognition: Noah notably includes details about recognition he received for his work. Mentioning these awards lends credibility to his claims of being a high-performing professional.

What could be done better?

- Personalized addressing: The applicant starts his cover letter with a generic and outdated "To whom it may concern". A better approach would be to directly address the hiring manager or the person responsible for recruitment, when such information is available.

- Length of cover letter: Noah's cover letter, while comprehensive, runs slightly long. A more concise letter can have a more powerful impact, as it respects the time constraints of hiring managers who may have to read through numerous applications.

- Brisk closure: The closing of Noah's cover letter comes across as abrupt and lacks a compelling finish. Wrapping up by reaffirming his value proposition and enthusiasm towards the role would make for a more balanced and effective closure.

1. Properly format your tax services cover letter

While the content of your tax services cover letter is the star of the show, the formatting plays a crucial role in making it shine. Here are some essential tips to get your cover letter format right.

- Choose a professional font: Stick to traditional fonts like Arial or Times New Roman in 11 or 12 points.

- Keep it short: Your cover letter should ideally be a single page. Employers have little time, and brevity shows your ability to distill complex information — a key skill in tax services.

- Use standard margins: A 1-inch margin all around your cover letter looks clean and professional.

- Line spacing: Single or 1.15 line spacing makes the cover letter comfortable to read.

- Digital format: If you're emailing your cover letter, save it as a PDF. This preserves your formatting across different devices.

- Clear sections: Use a blank line to separate each section, like the opening, body paragraphs, and conclusion. This helps employers to quickly scan your cover letter and find information they need.

Remember, your cover letter is your first impression. Make it a professional and easily navigable one to help the recruiter see you as a strong candidate for the tax services role.

2. Create a well-formatted tax services cover letter header & headline

The first step to writing an effective cover letter is to create a well-formatted header and headline.

A cover letter header includes all the necessary identifying information about the applicant and company, while a cover letter headline serves as a title that hooks the attention of the employer.

Below, we have provided more in-depth explanations and examples of each of these cover letter elements:

Formatting the header

Within your cover letter header, you should aim to have between 3 to 4 lines of text that include:

- Your name and professional title, your professional contact information (phone number, email address, etc.)

- The hiring manager's name and title, the company name, and the company address

Bad example of a cover letter header:

John Smith, johnsmith@email.com, Today

Why is it weak? This header lacks structure and essential details. It only includes the sender's name and email address, missing out on a professional title, contact number, and the date of sending. It also omits the recipient's information, making it seem impersonal.

Good example of a cover letter header on a tax services cover letter

From: John Smith, Tax Services Professional | (123) 456-7890 | johnsmith@email.com | linkedin.com/in/john-smith

To: Michael Page, Hiring Manager

Tech Forward Co.

1234 Their St

Their City, State, Zip

Why does it work? This header follows a structured format, providing all relevant details about the sender and recipient. This information, well-spaced and easily readable, immediately communicates professionalism. John Smith's title and the inclusion of his LinkedIn profile link provide useful context about his professional background.

Writing the headline

The headline of your cover letter is like the marquee of your professional theatre. It needs to be intriguing yet concise, promising an interesting story, but without giving all away at once. So, how do you craft the perfect headline for a tax services cover letter? Let's investigate.

Bad example of a cover letter headline

Application for Tax Services Position

Why is it weak? The headline is accurate but doesn't capture attention. It's generic and feels more like a label than an introduction, making your cover letter easy to get lost in the pile.

Good example of a cover letter headline

Certified Tax Professional with 10+ Years of Experience Aiming to Leverage Proven Record of 30% Tax Savings for ABC Corp.

Why is it good? This headline is packed with specifics. It shows the candidate's credentials (certified, 10+ years of experience) and quantifiable success (30% tax savings). By tying this success to an identifiable entity (ABC Corp), the candidate demonstrates a real-world application of their skills while also piquing the interest of the reader to learn how this was achieved.

3. Craft a personalized greeting on your tax services cover letter

Whenever possible, it is essential to include a personalized greeting within your cover letter.

Unlike generalized greetings — such as “To Whom It May Concern” — a personalized greeting will address a specific person or department by name. In doing so, this shows an employer you have conducted thorough research on their company and have great attention to detail.

Personalized greeting examples

- Dear Mr. Peterson,

- Dear Mr Lionel Peterson,

- Dear Hiring Manager Lionel Peterson,

If you are unable to uncover the exact person or department that will review your application, try out one of these alternatives:

General greeting examples

- To the [Company Name] Team

- To the [Company Name] Hiring Manager

Pro tip: If the job listing doesn't name the hiring manager, research it. Try checking the company's 'About Us' page or use LinkedIn. If still in doubt, don’t hesitate to call the company. Personalizing your letter can give you an edge.

4. Write a memorable tax services cover letter introduction

Your cover letter's introduction plays a pivotal role in setting the tone for the rest of your application. To make it truly memorable, aim to include:

• A snapshot of your professional background and aspirations

• Reasoning behind your keen interest in this specific company

• Reference to a shared contact, if available

Let's consider two examples and analyze them:

Bad cover letter opening example

To whom it may concern,

I work in tax preparation and heard about your company's open position.

Why is it weak? This introduction is too vague and offers no detailed explanation of the candidate’s qualifications. It lacks both personal touch — addressing it to a specific person, and specificity about the candidate’s background and professional experience.

Here is an example to help demonstrate how to write a tax services cover letter introduction

To the [Company Name] Hiring Manager,

I am a Tax Services professional with 4+ years of experience preparing taxes for high-level corporate clients. Your business partner, Jack Doe, has employed me as his personal Tax Advisor for the past 2 years and recommended I apply for this position.

Why is it strong? This candidate starts with an overview of their experience in tax services and provides specifics about their clientele. Moreover, mentioning their professional relationship with a known associate of the company validates their credibility and expresses a personal connection to the prospective employer. Establishing such a connection right at the onset of the cover letter enhances the probability of it being read further.

5. Showcase your value & accomplishments as a tax services professional

After your cover letter introduction is squared away, your next step is to write the body paragraphs of your letter. Ideally, your cover letter should contain between 2 to 4 body paragraphs that offer detailed answers to the following questions.

- What excites you about working at this company?

- What do you hope to learn from working at this company?

- What accomplishments or qualifications make you stand out as an applicant?

- What key skills do you possess that are relevant to the position?

While offering answers to each of these questions is important, focusing on accomplishments is particularly crucial. This is because your relevant accomplishments help to show employers the real-life value you can bring to their company.

And how else to bring your accomplishments to life if not using powerful language? The use of action words in a tax services cover letter is vital to impress employers with your accomplishments and demonstrate the value you can bring to their company.

Here are a few action words for your tax services cover letter

- Optimized

- Identified

- Increased

- Reduced

- Engineered

- Streamlined

- Facilitated

- Spearheaded

- Implemented

- Enhanced

These words add a dynamic quality to your experiences and emphasize your ability to deliver results. They create imagery around you as an active and effectual contributor who isn’t merely present in a role but plays an integral part in driving achievements.

Here's an example of how to describe an accomplishment in a tax services cover letter

As a Tax Services professional at [Former Employer], I optimized the company’s record filing system to reduce tax preparation time by 30% annually. Additionally, I identified 10 additional write-offs and deductions the company could claim, increasing their annual tax return by 15%.

6. End your tax services cover letter with a strong closing statement

To conclude your cover letter, you need a strong closing statement that offers actionable details, including:

- An enthusiastic sentence saying you are looking forward to hearing from them

- An additional sentence stating you will follow up, including how you will contact them or how they can contact you

- A formal sign-off

Bad example of a cover letter closing statement

Thanks for your time. Hoping to talk to you soon.

Yours,

[Applicant Name]

Why does it fall short? This lacks enthusiasm, specific follow-up plans, and personal contact information. While technically polite, it doesn't showcase the candidate's interest in moving the application forward.

Here is an example of an effective closing statement from a tax services cover letter

As your new Tax Services professional, I will dedicate my time to optimizing your tax preparation activities and maximizing your returns. I am eager to further discuss this opportunity with you directly and am available to schedule a meeting every weekday from 10 a.m. to 4 p.m. The best way to reach me is at (123) 456-7890.

Warm Regards,

[Applicant Name]

Why does this example work? This applicant offers value directly aligned with the job's core requirements, expressing readiness to contribute. Explicitly mentioning availability and a preferred contact method demonstrates transparency and eagerness to proceed. This closing statement captures the right tone — formal yet warm, asserting the candidate's strong interest in the role.

7. Avoid common mistakes in a tax services cover letter

Even a few missteps can make a big difference in the effectiveness of your cover letter. Let's talk about some common mistakes and how you can dodge them:

- Too lengthy: Recruiters have many applications to review, so they appreciate brevity. A cover letter longer than a page might not be read thoroughly. Be concise and keep your content focused.

- Typos and grammar errors: Nothing suggests haste and neglect like a cover letter littered with spelling and grammatical errors. Review your work carefully. Even better, have someone proofread it for you.

- Generic address: "To whom it may concern" sounds impersonal, and it can seem lazy. Do some research to find the hiring manager's name. LinkedIn and the company's website can be great sources.

- Inadequate customization: A generic cover letter is likely to be ignored. Tailor each cover letter for the job you're applying to, aligning your skills and experience with the job requirements.

- Neglecting company values: If your cover letter talks only about you and your achievements, it might come across as self-centered. Make sure to address why you are a good fit for this specific company and their values.

The goal is making your cover letter as robust and compelling as possible, and avoiding these common mistakes will certainly boost your chances of progressing in the job application process.

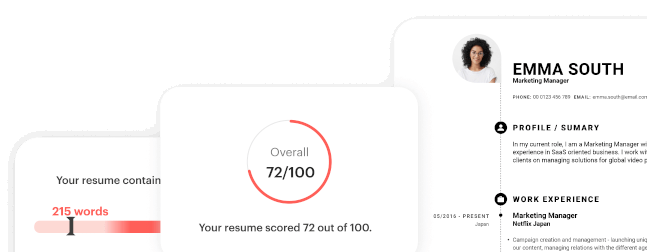

8. Pair your tax services cover letter and resume

While they work as a team, your cover letter and resume have different roles in your application. Let's delve into these differences and discuss how to pair them successfully.

A cover letter weaves your professional story. It highlights your passion for the job, details why you're attracted to the company, and expresses value you can add to their team.

On the flip side, your resume is a quick, factual overview of your skills, experience, and accomplishments. Think of it as a concise, chronological summary of your professional journey.

These two documents should mirror each other visually. A matching design keeps your application consistent and portrays a professional image. From the font and typography to your header and color schemes, maintaining uniformity also eases the reader's task — a detail that could work in your favor.

In a nutshell, use your tax services cover letter and resume as complementary parts of your application: woven together, they narrate your professional story. Keep the design synchronized to present a cohesive and professional image for best results.

9. Average salary and job outlook for tax services professionals

Working as a tax accountant or auditor isn't just about crunching transaction numbers — it's also about seeing some impressive numbers in your own salary! This career path offers substantial financial rewards and a solid outlook for job prospects.

According to the Bureau of Labor Statistics, as of May 2022, these professionals earned an average annual salary of $78,000. That's a substantial paycheck in return for your number-crunching skills!

But the benefits don't end there. The job market forecast looks promising, too. Employment within the accounting and auditing sector is projected to grow 4% from 2022 to 2032. That's roughly in line with the overall job growth forecast.

Better yet, there's no shortage of work. Over the next decade, it's expected that an average of 126,500 openings for accountants and auditors will be created each year.

Whether you're about to enter the field or considering a career switch, the prospect of becoming a tax accountant or auditor carries bright and promising opportunities.

10. Valuable job search resources for tax services professionals

Navigating the job market as a tax services professional might feel a bit daunting. But don't worry, we've gathered the best resources to take some of that weight off your shoulders:

- Professional job boards: Many job platforms such as Indeed, LinkedIn, and Glassdoor display posts for tax services roles. For industry-specific job sites, check out TaxTalent or AccountingJobsToday.

- Networking platforms: LinkedIn takes the crown here. Not only can you find job postings, but you can also connect with other tax professionals, join related groups, and stay updated on industry news.

- Professional organizations: Join groups like The National Association of Tax Professionals (NATP) or the Taxation section of the American Bar Association. They can provide you with professional development resources, networking opportunities, and job listings.

- Career services: If you're still studying or have recently graduated, your university's career service office can be a great asset. They often have job placement help, resume assistance, and other useful resources.

- Recruitment agencies: Several firms like Robert Half and Randstad specialize in roles for finance and tax professionals.

Remember, the more resources you utilize, the better your chances of finding the perfect role. Time to put those job-hunting skills into action!

Follow this cover letter outline for maximum success.

Tax Services Cover Letter FAQ

Your cover letter should include your personal contact information, the date, and the company's contact information. Start with a professional greeting, a compelling opening line, and an introduction. Then detail your relevant experience, important skills, and why you're interested in the role. Finally, include a strong closing statement and your signature.

Customise each cover letter by incorporating the job description's keywords and focusing on your skills that best suit the job requirements. Make sure to research the company and mention how your expertise can benefit their specific needs.

A cover letter should be concise and impactful, usually no more than a page long. Aim for three to four brief paragraphs.

A cover letter is an excellent opportunity to stand out and showcase your personal brand, illustrating your skills and experience in a way that your resume cannot. It allows you to explain why you're enthusiastic about the role and how you can contribute to the company.

While it might be tempting to save time, it's crucial to tailor each cover letter to the specific job application. Alignment with the job description and company values can demonstrate your attention to detail and interest in the role.